Monday, June 22, 2009

Sunday, June 21, 2009

Debonair Development Coming to Woodley Park

Labels: Ashbourne Developments, HPRB, Monarc Construction, new apartments, studio 27, Woodley Park

Woodley Park may soon become still more debonair now that the owners of the Debonair Cleaners at 2610 Connecticut Avenue, NW, Shahram and Maria Taginya, have taken on Annapolis-based developers Ashbourne Developments LLC to construct a four-story residential building directly behind their storefront.

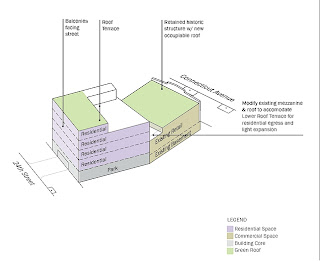

Woodley Park may soon become still more debonair now that the owners of the Debonair Cleaners at 2610 Connecticut Avenue, NW, Shahram and Maria Taginya, have taken on Annapolis-based developers Ashbourne Developments LLC to construct a four-story residential building directly behind their storefront. Entitled, surprisingly enough, the Debonair Residences, the project will include "up to" 14 residential units and span the length of the existing one-story commercial outlets on site - Fusion's Alley restaurant and Baskin Robbins, to name a few - from 2608-2612 Connecticut Avenue, NW, directly next to the Woodley Park-Zoo/Adams Morgan Metro. A rear-entry garage will be built at basement level for residents coping with the scarcity of parking along the retail strip and be accessible from 24th Street.

Plans by Studio 27 Architecture include balconies overlooking 24th, with a fourth-story roof terrace, but the historically protected commercial building facing Connecticut will be simultaneously “renovated and restored to a condition respectful of the original architecture” - i.e. the original height and roofline will remain along Connecticut Avenue.

Entitled, surprisingly enough, the Debonair Residences, the project will include "up to" 14 residential units and span the length of the existing one-story commercial outlets on site - Fusion's Alley restaurant and Baskin Robbins, to name a few - from 2608-2612 Connecticut Avenue, NW, directly next to the Woodley Park-Zoo/Adams Morgan Metro. A rear-entry garage will be built at basement level for residents coping with the scarcity of parking along the retail strip and be accessible from 24th Street.

Plans by Studio 27 Architecture include balconies overlooking 24th, with a fourth-story roof terrace, but the historically protected commercial building facing Connecticut will be simultaneously “renovated and restored to a condition respectful of the original architecture” - i.e. the original height and roofline will remain along Connecticut Avenue.

According to Ashbourne President Crispin Etherington, a June 15th meeting with the local ANC 3C went “swimmingly,” though the project’s scheduled appearance before the District’s Historic Preservation Review Board (HPRB) has been pushed back to July for unspecified reasons. Ashbourne is currently projecting a third quarter 2009 start date for the Debonair “with delivery in the spring of 2010,” though a final construction schedule is contingent on HPRB approval. Monarc Construction will serve as general contractor.

According to Ashbourne President Crispin Etherington, a June 15th meeting with the local ANC 3C went “swimmingly,” though the project’s scheduled appearance before the District’s Historic Preservation Review Board (HPRB) has been pushed back to July for unspecified reasons. Ashbourne is currently projecting a third quarter 2009 start date for the Debonair “with delivery in the spring of 2010,” though a final construction schedule is contingent on HPRB approval. Monarc Construction will serve as general contractor.Thursday, June 18, 2009

Shovel-Ready for 2010: CityCenter?

With the economy slowing real estate development (just a touch), developers are finding themselves on the defensive about projects in the planning stage. A skeptical public might think it a case of protesting too much, but promoters seem compelled to assuage public doubt while

With the economy slowing real estate development (just a touch), developers are finding themselves on the defensive about projects in the planning stage. A skeptical public might think it a case of protesting too much, but promoters seem compelled to assuage public doubt while struggling to convince once-bitten investors. Case in point, the rumor mill was rife recently with reports that Archstone and Hines Interests’ redevelopment of the old Convention Center - the important and hugely visible CityCenter – was being taken off the table. Not so, says Ken Miller, a Senior Vice President at Archstone. In fact, despite issues with financing and retail partnering, according to Miller, DC might just be seeing the project sooner than cynics expect.

struggling to convince once-bitten investors. Case in point, the rumor mill was rife recently with reports that Archstone and Hines Interests’ redevelopment of the old Convention Center - the important and hugely visible CityCenter – was being taken off the table. Not so, says Ken Miller, a Senior Vice President at Archstone. In fact, despite issues with financing and retail partnering, according to Miller, DC might just be seeing the project sooner than cynics expect."We are within a year of breaking ground," said Miller. "We are continuously meeting and speaking with retailers that expressed interest."

And yet the project has missed several projected groundbreakings since the developers' first estimate of a groundbreaking by last January, and despite numerous assurances that the delay isn't affecting retail interest in CityCenter, no major retailers have been announced. The multi-phase, mixed-use  development will commandeer 10-acres of vacant downtown property to eventually realize 400,000 square feet of retail space, more than a million square feet of office space, 670 residential units and a 400-room “high-end” hotel with its own 100,000 square foot retail plaza, under a 99 year lease from the city. It may sound a little on the ambitious side, but Archstone claims they have more than enough time – and resources – to see it through.

development will commandeer 10-acres of vacant downtown property to eventually realize 400,000 square feet of retail space, more than a million square feet of office space, 670 residential units and a 400-room “high-end” hotel with its own 100,000 square foot retail plaza, under a 99 year lease from the city. It may sound a little on the ambitious side, but Archstone claims they have more than enough time – and resources – to see it through.

"At this point in time, we still have months to complete our construction documents and get our final permits and entitlements. We’re busy meeting with potential investors and banks that have expressed interest,” said Miller. “By year’s end, even though we’re in a challenging state with capital markets, we’ll be able to get the financing lined up and be able to break ground.”

The last time DCmud reported on the status of CityCenter last September, a Hines representative relayed that the project was “85% ready to go” and that the development team would seek a general contractor “in the next few weeks.” Though neither has yet transpired, there was recently one sign that wheels are again turning after a dour Spring; on April 28th, the development team met with potential contractors at a pre-bid "requirement conference."

The last time DCmud reported on the status of CityCenter last September, a Hines representative relayed that the project was “85% ready to go” and that the development team would seek a general contractor “in the next few weeks.” Though neither has yet transpired, there was recently one sign that wheels are again turning after a dour Spring; on April 28th, the development team met with potential contractors at a pre-bid "requirement conference."

The District Government swapped land in 2007 with Kingdon Gould, who gave up land on the site of the future Convention Center Marriott to get the northeast parcel of CityCenter from the District government (labeled 'District Parcel' in the rendering). Gould will be developing his land separately, but has also not committed in time or in scope, nor has the much discussed Convention Center Marriott broken ground yet.

Wednesday, June 17, 2009

Purple Line Vote Affirms Maryland "Rail on the Trail"

Labels: Bethesda, chevy chase, Coalition for Smart Growth, Metro, Prince George's County, Purple Line, Washington Area Bicyclists Association

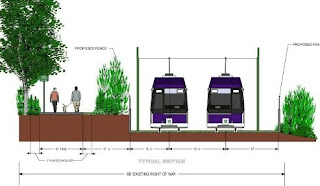

Bethesda and New Carrollton. The light-rail option, which has already received the support of both the Montgomery and Prince George's County Executives and County Councils, along with the Coalition for Smart Growth and the Washington Area Bicyclist Association, has faced a long string of criticisms from Bethesda/Chevy Chase area residents who fear that the project will render their three-mile spur of the Capital Crescent Trail system both physically and environmentally unsound.

Bethesda and New Carrollton. The light-rail option, which has already received the support of both the Montgomery and Prince George's County Executives and County Councils, along with the Coalition for Smart Growth and the Washington Area Bicyclist Association, has faced a long string of criticisms from Bethesda/Chevy Chase area residents who fear that the project will render their three-mile spur of the Capital Crescent Trail system both physically and environmentally unsound.Trail supporters lobbed various critiques at the Purple Line prior to the vote, including claims that it would make the area unsafe for schoolchildren, lead to the deforestation of Bethesda’s last remaining green space and the system will amount to little more than a “two billion dollar trolley line.” Others reasoned that the planned location of the Purple Line’s Bethesda depot at Woodmont East is too far away from the Metro, the National Institutes of Health and the soon-to-be relocated Walter Reed Army Medical Center to have any impact on traffic in the area. Anti-light rail advocates instead proffered that the NCTPB should endorse rapid bus service from Bethesda to Silver Spring as the Purple Line’s preferred mode of transport.

“Some of my constituents in Chevy Chase will advocate…bus rapid transit on Jones Bridge Road - [an alternative that] is not supported by the residents of Jones Bridge Road,” said Montgomery County Councilmember and Purple Line Now! founder, George Leventhal. “The difficulty that we have in proposing an alternative that is preferred by both counties, and that is likely to be endorsed imminently by Governor O’Malley, is that anywhere you try to move this transitway, you encounter other problems…This alternative, which is included in our master plan and has been endorsed by both counties, is indeed the right transitway for our congested, urban, inside-the-Beltway corridor.”

“Some of my constituents in Chevy Chase will advocate…bus rapid transit on Jones Bridge Road - [an alternative that] is not supported by the residents of Jones Bridge Road,” said Montgomery County Councilmember and Purple Line Now! founder, George Leventhal. “The difficulty that we have in proposing an alternative that is preferred by both counties, and that is likely to be endorsed imminently by Governor O’Malley, is that anywhere you try to move this transitway, you encounter other problems…This alternative, which is included in our master plan and has been endorsed by both counties, is indeed the right transitway for our congested, urban, inside-the-Beltway corridor.”Leventhal went onto to point out that his county initially acquired the Capital Crescent Trail for the express purpose of having both a “recreational hiker/biker trail” and future transit line at the same site.

“There would not be a trail today had not Montgomery County, back in 1990, acquired that right-of-way for the purpose of building what is now called the Purple Line,” he said.

Though some area organizations- most notably the Bethesda Civic Coalition's Save the Trail campaign, which collected some 18,000 signatures in support of their cause – opposed the plan, the majority of testimony submitted to the NCTPB

was overwhelmingly favorable. With an estimated daily ridership of between 42,000 and 46,000, many believe that the “Rail on the Trail” will provide a crucial east-west link between Montgomery and Prince George’s Counties, resulting in an economic boom for outlying communities and a more efficient Metro system. Even frequent trail users spoke out in support of the plan, illustrating just how multifaceted the Purple Line debate had become.

was overwhelmingly favorable. With an estimated daily ridership of between 42,000 and 46,000, many believe that the “Rail on the Trail” will provide a crucial east-west link between Montgomery and Prince George’s Counties, resulting in an economic boom for outlying communities and a more efficient Metro system. Even frequent trail users spoke out in support of the plan, illustrating just how multifaceted the Purple Line debate had become.“The media, unfortunately, portrays the issue of the Purple Line as black and white. You either support the Capital Crescent Trail or you support the Purple Line, but not both. That’s not the case with WABA,” said the cyclist organization's Executive Director, Eric Gilliand. “When finally constructed, the Purple Line will include a direct bike-ped link with the Silver Spring Transit Center, where it will eventually link with the Metropolitan Branch Trail coming out of DC. This is a critical bike/pedestrian transit project that must move forward.”

With NCTPB approval now in hand, the Purple Line’s next stop is with Maryland governor Martin O’Malley, who is expected to endorse the light-rail option and announce a timetable for construction by year’s end. In the meantime, NIMBYs on the other side of the Potomac can get ready for another Metro-centric debate now that plans for a proposed Silver Line, running from downtown Washington to Dulles Airport, are being openly discussed.

Founders Square Readies for Demo in Ballston

Labels: Arlington, Ballston, new apartments, Paradigm Development, retail, RTKL, Shooshan Company

It looks like Old Man Economy might have finally started taking his pills again. After gaining approval from the Arlington County Board in July of last year, the Shooshan Company's ambitious plans for Founders Square, a five-building, mega mixed-use development in Ballston, seemed about as promising as a GM-backed pension plan. But despite slippery start dates in all types of construction, Shooshan's Vice President of Development, Kelly Shooshan, tells DCmud the project is still on track for its originally scheduled 2009

It looks like Old Man Economy might have finally started taking his pills again. After gaining approval from the Arlington County Board in July of last year, the Shooshan Company's ambitious plans for Founders Square, a five-building, mega mixed-use development in Ballston, seemed about as promising as a GM-backed pension plan. But despite slippery start dates in all types of construction, Shooshan's Vice President of Development, Kelly Shooshan, tells DCmud the project is still on track for its originally scheduled 2009  groundbreaking and that the company will be seeking a general contractor before the summer is out.

"We're looking to probably be bidding the project in the middle of the summer and will probably start construction sometime in the fall or early winter," said Shooshan.

Located on 4.6-acre parcel bounded by North Randolph Street, Wilson Boulevard and North Quincy Street in Ballston, the RTKL Associates-designed development will replace the industrial and non-tax paying bus lot known simply as the WMATA site, a gas station, a recycling center and a tre chi-chi Super Pollo chicken joint. Founders Square is intended to house 26,000 square feet of retail space (8,000 of which the Shooshan Company has since farmed out to Paradigm Development), 730,000 square feet of office space in two towers, and another two worth of housing for a total of 378 residential units.

“The buses have been gone since March 27th,” said Shooshan. “When we start the project, it’ll start with demo…the site is just a one-story building, so it’s a very small portion of the construction timeline.”

“Super Pollo will be relocating to the new retail building and there are several other tenants that have expressed interest in the other two spaces in the retail building. It’s very small retail, only 8,000 square feet. The first office building is a secured office building, so it won’t have any retail in it." The secure building will, though, have enhanced security features suitable for defense-related businesses.

groundbreaking and that the company will be seeking a general contractor before the summer is out.

"We're looking to probably be bidding the project in the middle of the summer and will probably start construction sometime in the fall or early winter," said Shooshan.

Located on 4.6-acre parcel bounded by North Randolph Street, Wilson Boulevard and North Quincy Street in Ballston, the RTKL Associates-designed development will replace the industrial and non-tax paying bus lot known simply as the WMATA site, a gas station, a recycling center and a tre chi-chi Super Pollo chicken joint. Founders Square is intended to house 26,000 square feet of retail space (8,000 of which the Shooshan Company has since farmed out to Paradigm Development), 730,000 square feet of office space in two towers, and another two worth of housing for a total of 378 residential units.

“The buses have been gone since March 27th,” said Shooshan. “When we start the project, it’ll start with demo…the site is just a one-story building, so it’s a very small portion of the construction timeline.”

“Super Pollo will be relocating to the new retail building and there are several other tenants that have expressed interest in the other two spaces in the retail building. It’s very small retail, only 8,000 square feet. The first office building is a secured office building, so it won’t have any retail in it." The secure building will, though, have enhanced security features suitable for defense-related businesses.

The development’s residential units are tentatively scheduled to hit the market as rentals and all five Founders' buildings will aim for a LEED certification. In the meantime, the developer has yet to definitively budget the project, as it is, in the words of Shooshan, “evolving over time with the present market conditions.”

"There’s such a large spread right now with construction prices decreasing every minute, it’s really hard to give a formula on the whole entire project,” she said. In 2008, Shooshan completed Liberty Center in Ballston, a 21-story, 469-unit residential building. Despite continued development, the rough and tumble Arlington 'hood has somehow managed to keep its street cred intact.

The development’s residential units are tentatively scheduled to hit the market as rentals and all five Founders' buildings will aim for a LEED certification. In the meantime, the developer has yet to definitively budget the project, as it is, in the words of Shooshan, “evolving over time with the present market conditions.”

"There’s such a large spread right now with construction prices decreasing every minute, it’s really hard to give a formula on the whole entire project,” she said. In 2008, Shooshan completed Liberty Center in Ballston, a 21-story, 469-unit residential building. Despite continued development, the rough and tumble Arlington 'hood has somehow managed to keep its street cred intact.Tuesday, June 16, 2009

The Dirt on...14th and U

Pawn shops no more

Pawn shops no moreAs any casual observer of the area can tell you, the post-riot 14th Street that used to host DC’s finest peep shows and open-air drug markets (RIP Shop Express) is long gone. True, there are probably a dozen dollar stores hocking Obama t-shirts and incense at any one time, but the retail scene has expanded beyond just Footlocker and tattoo artistry of Pinz-N-Needlez. While Whole Foods isn't too far way, the newly-opened boutique grocer, Yes! Organic, should satisfy the immediate needs of hummus-starved newcomers. In fact, the neighborhood today boasts DC’s most impressive array of niche-centric retail with everything from gourmet confectionery (Cake Love) to pricey custom furniture (Vastu) to comic books (Big Monkey) and hand-made jewelry (DC Stem), within walking distance of the U Street/Cardozo Metro station.

Real estate’s best bet

Two blocks north of the famed 14th and U interchange, DC's largest concentration of new condos and apartments is brewing, with more than 1000 new units of housing going up within a stone’s throw of 14th and W. Among those completed are PN Hoffman’s Union Row and Jair Lynch’s Solea condos, while Level 2’s View 14, UDR’s Nehemiah Center residential tower are under construction, and Perseus Realty’s 14W is scheduled to begin shortly. And, unlike, say, the area surrounding Nationals Park in Southeast, where neighborhood amenities are still absent after the residential building boom, U Street is already loaded with restaurants and nightlife of all stripes. And with Room & Board scheduled to open more than 30,000 s.f. of retail space next year, expect much more visibility for the neighborhood.

Eating out: it’s not just half-smokes anymore

While Taco Bell and McDonald's might be the most popular dining establishments (at least at 2 am), the inroads made by funky restaurants like Busboys and Poets, Marvin (country fried chicken and waffles--who knew?) and Tabaq have gone a long way to bringing some flavor to the neighborhood. In the past months, newly opened establishments like cajun/soul food eatery, Eatonville, and The Gibson, where mixologists design the perfect cocktail, have been abuzz in the press and are the newly-minted, go-to destinations for urbanistas city- (and suburb) wide. Even greasy spoon and DC dive landmark Ben’s Chili Bowl has moved upscale by opening a white table cloth eatery, Ben’s Next Door. After you've over-indulged, you can work it off with an Urban Funk Class at Results Gym.

While Taco Bell and McDonald's might be the most popular dining establishments (at least at 2 am), the inroads made by funky restaurants like Busboys and Poets, Marvin (country fried chicken and waffles--who knew?) and Tabaq have gone a long way to bringing some flavor to the neighborhood. In the past months, newly opened establishments like cajun/soul food eatery, Eatonville, and The Gibson, where mixologists design the perfect cocktail, have been abuzz in the press and are the newly-minted, go-to destinations for urbanistas city- (and suburb) wide. Even greasy spoon and DC dive landmark Ben’s Chili Bowl has moved upscale by opening a white table cloth eatery, Ben’s Next Door. After you've over-indulged, you can work it off with an Urban Funk Class at Results Gym. Adams Morgan ain’t got nothing on U Street

While nearby Adam’s Morgan may have one thing going for it (read: boozed-up college kids), U Street’s approach to nightlife is more diversified with culture: The Lincoln Theater and Source Theater, DC's most eccentric sports bar, Nellie's, and a laundry list of music venues (The 9:30 Club, Black Cat, DC9, and the Velvet Lounge) share space next to bars that (gasp) don’t specialize in jell-o shots and specials on Miller Lite…not that there’s anything wrong with that.

Nonetheless, don't be afraid to chill out. This is a neighborhood with not one, not two, but three yoga studios after all. Santa Monica, here we come.

Monday, June 15, 2009

Architects’ Institute LEEDs the Way Downtown

Finally leading by example, The American Institute of Architects (AIA) has gotten the go-ahead from the National Capital Planning Commission (NCPC) to pursue an extensive renovation of their headquarters at 1735 New York Avenue, NW that would see the 36-year-old office building become a LEED-platinum

Finally leading by example, The American Institute of Architects (AIA) has gotten the go-ahead from the National Capital Planning Commission (NCPC) to pursue an extensive renovation of their headquarters at 1735 New York Avenue, NW that would see the 36-year-old office building become a LEED-platinum certified facility - making it the first such eco-friendly "do-over" in the history of the District. In the words of NCPC, it would allow the AIA's national headquarters to serve as a "national model of sustainable design and construction."

certified facility - making it the first such eco-friendly "do-over" in the history of the District. In the words of NCPC, it would allow the AIA's national headquarters to serve as a "national model of sustainable design and construction."  for a newly relocated storefront can proceed unimpeded. A hearing on the matter has yet to scheduled, but if and when the AIA is successful, their newly re-modeled headquarters will join just a handful of LEED-plantinum certified developments in Washington DC. At present, there are only three: PNC Financial Services Group Inc. / Vornado/Charles E. Smith’s Gensler-designed office building at 800 17th Street NW, Sidwell Friends' Middle School addition in Cleveland Park and the US Green Building Council’s (who themselves administrate the LEED program) 22,000-square foot office suite in Dupont Circle.

for a newly relocated storefront can proceed unimpeded. A hearing on the matter has yet to scheduled, but if and when the AIA is successful, their newly re-modeled headquarters will join just a handful of LEED-plantinum certified developments in Washington DC. At present, there are only three: PNC Financial Services Group Inc. / Vornado/Charles E. Smith’s Gensler-designed office building at 800 17th Street NW, Sidwell Friends' Middle School addition in Cleveland Park and the US Green Building Council’s (who themselves administrate the LEED program) 22,000-square foot office suite in Dupont Circle.Sunday, June 14, 2009

Mount Pleasant's Raven Gets Expansion, Upgrade

Labels: manna, mt. pleasant, new condos, renovation

On the heels of a renovation to the three-story residences that wrapped up last year, one of DC's best dive bars, the Raven Grill at 3125 Mount Pleasant Street, NW, is now working on getting a new rear addition, plus an upgraded exterior, courtesy of Washington affordable housing developers, Manna, Inc.

On the heels of a renovation to the three-story residences that wrapped up last year, one of DC's best dive bars, the Raven Grill at 3125 Mount Pleasant Street, NW, is now working on getting a new rear addition, plus an upgraded exterior, courtesy of Washington affordable housing developers, Manna, Inc.

"We're trying to make it look like the original. If you look around the Raven and the [neighboring Mount Pleasant Dry Cleaners], you can see that there are still cracks. We need a new coating that looks like original," said George Rothman, President and CEO of Manna, Inc.

Manna’s in-house development, design and construction teams worked with the Raven’s owner, Merid Admassu, for the build-out of the Antonatl Condominiums - a name invoking an El Salvadoran war hero, which you already knew. Manna resurrected the 12-unit, affordable condo out of the charred remains of 13 fire-gutted apartments above the fabled watering hole, built in 1928 and gutted by fire in 2003. Work on the Raven itself will include a 300 to 500 square foot addition to the bar’s rear, primarily for storage space. Both projects should be completed in one fell swoop.

“The [condo] construction was probably completed in December and people have been living in it…We haven’t finished the front of the building yet because we’re finding a sub-contractor to do the specialized work with those windows,” said Rothman. “Everything inside is finished and the outside, we’ll probably do that when we’re doing the addition in the rear to the Raven.”

For those fearful that their designated hangout for three dollar PBR’s might lose some of its old-school DC charm, Rothman emphasized that the bar won’t be going anywhere and should be keeping normal business hours when work gets underway in the next four to six months.

“The Raven is an institution. It will stay. That’s always been important to us” he said.

Friday, June 12, 2009

Empty DC School Demolished for Park

schools, the city has decided to tear one down instead. According to documentation from District’s Office of Historic Preservation, OPM has received approval to demolish Gage-Eckington Elementary in LeDroit Park, following concerns about a lack of parking from a potential DC government tenant.

schools, the city has decided to tear one down instead. According to documentation from District’s Office of Historic Preservation, OPM has received approval to demolish Gage-Eckington Elementary in LeDroit Park, following concerns about a lack of parking from a potential DC government tenant. The 86,500 square foot building, which sits vacant at 2025 3rd Street, NW, had initially been considered as a new headquarters for the DC Department of Environment, which was quick to express its trepidation about the dearth of parking in the area. The school was definitively passed over once city officials balked at the reported $18 million worth of renovations and repairs needed to retrofit the facility (as presented here by frequent DCmud talkbacker, IMGoph, on his own Bloomingdale-centric site). So, instead of parking, the DC government has decided to go with a park.

In lieu of an agency relocation, Gage-Eckington will be razed to make way for a new public park designed by Lee + Papa and Associates. A final development scheme for the recreational area was approved at a meeting of the LeDroit Park Civic Association (LPCA) on May 26th and is set to include a dog park, a children’s garden, an environmental learning center and incorporate the already existing community garden at 3rd and V Streets, NW that adjoins the site. According to the LPCA, “Inside demolition of [the school] is scheduled to start on or about June 1. Exterior demo is expected to begin by August 1. Construction of the park is slated to begin on or about October 15.”

The LPCA had actively lobbied for the project via their "Put the Park Back in LeDroit Park" community campaign, which began shortly before Gage-Eckington Elementary closed its doors at the end of 2007-8 school year. It was a move expected to save DC Public Schools some $659,000 in “fixed costs” per year, but at the time, DCPS Chancellor Michelle Rhee and Deputy Mayor for Education Victor Reinoso said specifically of Gage-Eckington:

The LPCA had actively lobbied for the project via their "Put the Park Back in LeDroit Park" community campaign, which began shortly before Gage-Eckington Elementary closed its doors at the end of 2007-8 school year. It was a move expected to save DC Public Schools some $659,000 in “fixed costs” per year, but at the time, DCPS Chancellor Michelle Rhee and Deputy Mayor for Education Victor Reinoso said specifically of Gage-Eckington:

We intend to use buildings for the benefit of our city…[and it] could be used to house an early childhood or adult education program, a student and family health center, or another city agency…The Mayor has no plans to sell the property or allow it to fall into disrepair or unmonitored use.

Not to be confused with LeDroit Park’s other Gage school, the N.P Gage School at 2035 2nd Street, NW that was replaced by Gage-Eckington (only to sit unoccupied for 25 years), and which was transformed into the Parker Flats at Gage School by Urban Realty Advisors and Bonstra Haresign Architects in 2005.

Washington DC retail and real estate development journal

NPR to Start Work on New NoMa HQ

It's time turn down the volume on 88.5 FM and swap out your cardigan and khakis for a Hazmat suit, because work on National Public Radio's new NoMa headquarters will begin next month.

It's time turn down the volume on 88.5 FM and swap out your cardigan and khakis for a Hazmat suit, because work on National Public Radio's new NoMa headquarters will begin next month.

NPR's new 400,000-s.f. HQ at 1111 North Capitol Street, NE, will rise from an expansion and renovation of the Chesapeake and Potomac Telephone Companies Warehouse and Repair Facility presently on site. The historically-protected (and Meads Row isn't?) 83-year-old structure, however, is rife with toxic substances, including asbestos, the removal of which will constitute the first phase of development since the project was announced one year ago.

"The abatement of hazardous materials from the inside of the building and the interior demolition [will begin] in July," said NPR media contact, Danielle Deabler. “The actual construction is anticipated in late 2010 or early 2011…Our move-in date is fall 2013.”

Given the lengthy timeline in place for a full build-out of the new headquarters, Deabler tells DCmud that NPR’s development team for the project - Boston Properties and Hickok Cole Architects - have yet to produce a final design scheme for NoMa’s newest corporate high-rise. According to the NPR rep, a picture of the supposed façade that made the rounds a few months back was merely an example of Hickok Cole’s preliminary vision for the site.

“We don’t have a rendering that we are releasing publicly right now. The only rendering that has been drawn up is the one [the architects] used to bid with. Since that most likely won’t be won’t it looks like, we don’t have a final [design] to show yet,” said Deabler.

The development team is currently in the process of selecting a general contractor for hazmat removal and construction. Final bids were due on June 2nd and a final choice will be announced shortly. (Expect NPR's pledge drive to be even more intense this year, as well.) Meanwhile, NoMa's first hotel opened its doors last week.

Thursday, June 11, 2009

DC Reveals Management and Style Guidelines for City Property

Labels: HOK Architecture, Minnesota-Benning, OPM, Washington DC

managing and consolidating the DC government's 18 million square feet plus of property and 3.7 million square feet of privately leased space in a streamlined and cost efficient manner.

managing and consolidating the DC government's 18 million square feet plus of property and 3.7 million square feet of privately leased space in a streamlined and cost efficient manner.The OPM plan outlines measures that will reduce the city's amount of leased space by 13% (roughly 500,000 square feet) over the next year by relocating staff to shuttered DC public schools and consolidating warehouse operations. It also provides concrete timelines for the construction of new District-owned office space - including the currently underway Department of Employee Services at Benning Road and Minnesota Avenue, NE (pictured) and the recently announced MPD Property and Evidence Warehouse in Southwest. DC Public Schools and Libraries, however, will be unaffected by the Facilities Plan, as they are governed by their own distinct agencies.

The plan includes a provision requiring all DC-sponsored projects to meet a minimum LEED silver certification. OPM Director Robin-Eve Jasper did, however, point out that the plan is “Version 1.0” and will be subject to revision as new opportunities present themselves.

The plan includes a provision requiring all DC-sponsored projects to meet a minimum LEED silver certification. OPM Director Robin-Eve Jasper did, however, point out that the plan is “Version 1.0” and will be subject to revision as new opportunities present themselves."A lot of things change about property – about the needs, about the market and other things - are very dynamic in real estate. We will be regularly updating this plan to address new things that come up,” said Jasper.

In addition to the master Facilities Plan, OPM also used the occasion to announce the release of its HOK Architects-authored (and phone book thick) Workplace Design Guidelines that, in the words of District reps, “standardizes the materials and furnishings that can be used in District office buildings” through bulk purchases and codified style standards.

“This will be a common brand making sure that efficiencies bring big cost savings,” said Fenty. Because, as we all know, the best way to attract DC’s best and brightest to local government is by forcing them to all use identical mauve swivel chairs in their mass produced cubicles. Oy.

Wednesday, June 10, 2009

Room and Board Buys into 14th Street

Labels: 14th Street, Eric Colbert, renovation, retail, U Street

Minneapolis-based home furniture retailers Room and Board have purchased a vacant, four-story building at 1840 14th Street, NW and plan to transform it into a fully rehabbed, 33,000 square foot flagship location - their first in the DC metro area. According to the broker

Minneapolis-based home furniture retailers Room and Board have purchased a vacant, four-story building at 1840 14th Street, NW and plan to transform it into a fully rehabbed, 33,000 square foot flagship location - their first in the DC metro area. According to the broker who facilitated the purchase, Wayne Dickson of Blake Dickson Real Estate, the retail chain has big plans for the re-emergent 14th Street corridor and will use the entire space for their showroom.

who facilitated the purchase, Wayne Dickson of Blake Dickson Real Estate, the retail chain has big plans for the re-emergent 14th Street corridor and will use the entire space for their showroom."Room and Board is expecting this to be a regional draw for them...Through their catalog sales, they did a zip code analysis of where the majority of their customers were. The building at 1840 14th Street was just about dead center in that customer base," he said.

Known to some as the Taylor Motor Building, 1840 14th Street began its life as a Ford Model A showroom, and, in subsequent decades, went on to to serve an array of uses, including stints as an arts space and church. Most recently, the building was slated for a residential makeover by Four Points, LLC, which paid some $10 million for the site. Plans for that project, the so-called T Street Flats, (or "Rapture Lofts") were announced in 2007, but never made it past the planning stages.

"Blake Dickson Real Estate has been working on that property for the better part of two years…It was most recently a church, called the Church of the Rapture, and then the initial plans by Four Points, LLC had a condo element,” said Dickson. “They bought that building at the top of the market and then later decided to go all commercial with it.”

"Blake Dickson Real Estate has been working on that property for the better part of two years…It was most recently a church, called the Church of the Rapture, and then the initial plans by Four Points, LLC had a condo element,” said Dickson. “They bought that building at the top of the market and then later decided to go all commercial with it.”As purveyors of handcrafted, American-made furniture, Room and Board will be among the latest in a string of upscale chain retailers, including Bang and Olufsen and Whole Foods, to set up shop along the once unfashionable 14th Street corridor - the same strip that recently lost its Storehouse furniture retailer, only to gain Mitchell Gold in its place. One block over at 14th and S Streets, NW, the JBG Companies also have plans on the boards for a new mixed-use complex with ground-floor retail. (Once that Apple Store gets announced, consider gentrification complete.)

Room and Board have retained omnipresent DC architects, Eric Colbert and Associates, to design the extensive renovation, which Dickson described as a “gut job.” The build-out is expected to take between 12 and 18 months.

Tuesday, June 09, 2009

Meads Row Bids Adieu to the Atlas District

Late last month, Washington DC's Historic Preservation Review Board voted down a motion for the protection of Meads Row – a series of nearly century-old structures at 1305-1311 H Street, NE that owners Tae and Sang Ryu plan to demolish to make way for a new Atlas District parking lot, much to the dismay of the ANC 6A. With no recourse now left to the ANC, the owners are free to pursue a raze for the

Late last month, Washington DC's Historic Preservation Review Board voted down a motion for the protection of Meads Row – a series of nearly century-old structures at 1305-1311 H Street, NE that owners Tae and Sang Ryu plan to demolish to make way for a new Atlas District parking lot, much to the dismay of the ANC 6A. With no recourse now left to the ANC, the owners are free to pursue a raze for the property, although, in the view of some city officials, the Ryu's new pay-to-park will have anything but a positive effect on the increasingly developed H Street corridor.

property, although, in the view of some city officials, the Ryu's new pay-to-park will have anything but a positive effect on the increasingly developed H Street corridor. The Floridian Goes South?

Labels: Eric Colbert, Florida Ave., Kady Development, new condos, Shaw, Tompkins Builders

Buyers at The Floridian condominium in Shaw received some unwelcome if unfortunately common news last week when they were informed they would be unable to settle on their contracts until a lien and lawsuit involving one of the lenders was resolved. The condo project at 919-929 Florida Avenue, by Kady Development, has been funded by "a number of different" lenders, including Bank of America. Contract holders have had their settlements delayed until the disputes are resolved.

Buyers at The Floridian condominium in Shaw received some unwelcome if unfortunately common news last week when they were informed they would be unable to settle on their contracts until a lien and lawsuit involving one of the lenders was resolved. The condo project at 919-929 Florida Avenue, by Kady Development, has been funded by "a number of different" lenders, including Bank of America. Contract holders have had their settlements delayed until the disputes are resolved.

"The situation is that the seller, about three weeks ago, disclosed to all of our potential purchasers and [current] owners that he is having an issue with the lender and hopes to get it resolved within - what he said at the time - a month, but that he couldn’t be certain. So, we've been working with anyone who is under contract and new potential buyers and telling them that information,” said Gerard DiRuggiero of Urban Land Company.

“[We] can’t settle [contracts] at the moment. So, it’s just weekly updates and we’ve cleared that with all the buyers. Again, people are remarkably flexible and we’re giving them the information that we know. The residents seem to be handling it well and they love the building and the location,” said DiRuggiero. The Florida Avenue project sits amid several sites that were intended for development, such as the Atlantic Plumbing site, but that never materialized.

However, as of last week, the 118-units in the development’s dual, Eric Colbert-designed 8-story towers boasted an occupancy rate of 50% according to the sales team, though DC government records show only 29 recorded sales - after having begun sales in October 2005 and beginning settlements in the first half of 2008. Like the Metropole, a nearby project which was taken over by the lender in April and has been all but invisible since, the Floridian’s sales center at 913 Florida Avenue, NW, remains technically open for business…for now, at least, but without a date certain for resolving the issue. The project was built by Tompkins Builders.

However, as of last week, the 118-units in the development’s dual, Eric Colbert-designed 8-story towers boasted an occupancy rate of 50% according to the sales team, though DC government records show only 29 recorded sales - after having begun sales in October 2005 and beginning settlements in the first half of 2008. Like the Metropole, a nearby project which was taken over by the lender in April and has been all but invisible since, the Floridian’s sales center at 913 Florida Avenue, NW, remains technically open for business…for now, at least, but without a date certain for resolving the issue. The project was built by Tompkins Builders.

Post your comments about this project below

Tweaking Hine or Six to Four

Two weeks after publishing a short list of potential developers for a dilapidated Eastern Market school, the Washington DC government has announced that it has cleaved two of the six developers from the list. District officials

announced that Quadrangle Development and Equity Residential/Mosaid Urban Partners were off the list to develop the Hine Junior High School at 335 8th Street, SE, leaving four contenders.

announced that Quadrangle Development and Equity Residential/Mosaid Urban Partners were off the list to develop the Hine Junior High School at 335 8th Street, SE, leaving four contenders. The 43-year-old, 131,300 square foot educational facility was shuttered in 2007, in order to redirect $6.2 million worth of school funds toward leasing costs for the District of Columbia Public Schools' headquarters. Developers have proposed a variety of retail, non-profit, housing and office uses for the building. The four survivors are:

1. The Bozzuto Group/Scallan Properties/Lehr Jackson Associates/E.R. Bacon Development, LLC/Blue Skye Development/CityStrategy, LLC

2. National Leadership Campus/Western Development Group

3. Stanton Development Corporation/Eastbanc Inc./Autopark Inc./The Jarvis Companies/Dantes Partners

4. StreetSense/DSF/Menkiti Group

A few lucky District officials will host a discussion panel on the property on June 10th at Tyler Elementary at 1001 G Street, SE. The meeting will begin at 6 PM and is open to the public. Eastern Market will officially reopen on June 25th.

Sunday, June 07, 2009

Industry Insight: Steve Schwat of Urban Investment Partners

Labels: interview, new apartments, new condos, renovation, UIP Development

UIP principal Steve Schwat has overseen a diverse portfolio of real estate and development projects in Washington, DC and Prince George's County. In addition to owning and/or managing roughly 2800 rental units throughout the city, the firm has developed several for-sale condo projects, including The Archbold in Glover Park and Providence Square on Capitol Hill.

UIP principal Steve Schwat has overseen a diverse portfolio of real estate and development projects in Washington, DC and Prince George's County. In addition to owning and/or managing roughly 2800 rental units throughout the city, the firm has developed several for-sale condo projects, including The Archbold in Glover Park and Providence Square on Capitol Hill.

As the area condo market began its steep descent a few years back, UIP turned its focus to a practice Schwat calls the "value add" - a program that provides "substantial rehabilitation" to blighted or vacant buildings with updated amenities and streamlined utility systems. Schwat spoke with DCmud about UIP's expanding list of services and the state of DC development in general from their newly acquired Connecticut Avenue offices, directly beneath one such "value add" property currently under renovation: the historic Macklin apartment complex at 2911 Newark Street, NW.

Can you tell us a bit about how UIP came together and the work you do here at the firm?

I’m one of the original principals. There are three of us. We started back around 2000 and I have been in Washington since 1980, when I went to school at GW. I’m serial entrepreneur of sorts. I’ve owned a number of different businesses and I have a background in sales. My initial interest in real estate was doing single-family homes, and then I did my first condominium project in the early 80s, by renovating an older historic-type building. I sort of caught the renovation bug.

I enjoy starting companies, administrating companies and getting them running. What been as a hobby in real estate turned into a full blown career. My two partners, both of whom are Dutch, have been in real estate for a very long time. There was a combination of their deep experience in real estate investing and my knowledge of Washington and ability to create a functioning operation.

UIP doesn’t only operate as developer, but offers general contracting and property management services as well. Can you profile the organization for us?

UIP was always the rental group and all of our rental properties are owned under some kind of UIP entity. Drummond Development was our for-sale company and, if we do a for-sale project, it’s done under Drummond – just to keep the different types of investment separate. Then we have Urban CM, which is our construction group, and we currently do our own construction on projects up to $5 million. That may expand sometime in the next year or so if we do bigger projects.

Our property management group started in January of this year. We hired Dave Barton, who was running Randall Hagman’s residential management group, and when he resigned, they sort of sent him off with his staff and about 700 apartment units. So, we now manage our own properties. Before that, we were hiring third-party property managers…[but] we’d always envisioned having our own property management company, simply because we were constantly dissatisfied with the level of performance we got from other companies.

As it turned out, as the industry changes and the capital markets change and businesses are consolidating, we’d been considering it for so long that it didn’t seem like a consolidation move. In the end, in a market where you’re starting to worry about your ability to do as many deals this year as you did last year, it’s certainly a benefit to bring a fee-based entity in.

How do you go about finding and selecting properties for rehabilitation? They all seem to be historic, yet something with an architectural history like the Macklin seems like a more obvious choice than say, 1921 Kalorama.

The prominent history, from an investment perspective, is probably fifth down on the list of the top five priorities. It’s certainly more fun to do architecturally significant buildings than it is to do historically insignificant buildings...What we look for in a property if we’re going to do a "value add" is “Can we increase the rents? Can we decrease the expenses? Does the building need the improvements that we’re talking about? And is there a method within DC rent control that’s going to allow us to achieve those goals?”

That’s really the key when you’re marketing inside a rent controlled environment like the District of Columbia. It’s not a matter of looking for loopholes; it’s a matter of utilizing the system in a legal way, taking buildings that are in need of substantial rehabilitation, putting it all together, and, in the end, doing what is a justified renovation of the building.

But, in that, you have two things that directly conflict. One is the city’s desire to maintain affordable housing. [The second is that] if you’re going to pour a million dollars into a building to renovate it, that’s something that will cause you to increase, not decrease the rent. Dig one level deeper and that conflict becomes a reality where you have people living in grandfathered buildings with antiquated heating, cooling, and electrical systems…If you were to build that building today, it would never meet code. But because it’s been grandfathered in over so many years, it technically gets past the code. But that doesn’t mean  it’s safe or that the electrical system doesn’t need to be replaced.

it’s safe or that the electrical system doesn’t need to be replaced.

Within rent control, there are a number of tools you can use to increase rents. But you can’t just take a crapped out building and increase the rent because it’s still crapped out. You can’t take a building that you wouldn’t live in…and just raise the rents because that’s not very moral. So there’s a balance of working within the rent control environment and achieving that perfect storm of, “Is the property currently requiring improvement? Is the property currently renting below market rate? Is there a tool within a rent control that we can use to increase the rents while working with the Office of the Tenant Advocate and the Rent Administrator?...[That is] separate from my political opinions on what preserving and providing affordable housing should be. That is not to say that I agree 100% with the District, but there is the law and you have operate within it.

That said, some of the District’s rent control laws are antiquated and somewhat backwards in their thinking. The concept of maintaining affordable units in an otherwise upscale building has some inherent issues that are problematic...If you build $700,000 houses or condominiums, is it appropriate to have a $200,000 condominium in that building? Issues like amenities and monthly maintenance fees are also in direct conflict with one another.

Does UIP view new construction as profitable arm of the business? Or is the company content with sticking to renovations culled from DC’s vast inventory of vacant buildings?

Ironically, coincidentally, fortuitously, though, a renovation of a rental property…is very similar to the renovation you do for a condominium because you have to self-contain utilities and make it simple, so that someone can own it. There’s a lot of synergy there in renovating a building for rental, where you’re reducing your expenses. Part of our whole “value add” strategy is not only increasing the rents, but also decreasing your expenses from five, six grand per unit per year to something less than three grand because you’re not heating the building with a highly inefficient furnace that burns all day long…as opposed to replacing it with a self-contained unit that the tenant is responsible for. It’s amazing how green a technology that is…If leave, I turn it off; I come home, I turn it on.

The definition of “value add” is in how you exit and, if there’s one thing I’d like to say, it’s that “It’s the exit, stupid”…I like to talk about my condominium experience because we did a lot of “value add” renovations with condos. People go, “Oh no, condos,” but the sale of a condominium and the sale of an apartment building is the same thing. It’s just a contract selling one on a wholesale basis and another selling condominiums on a retail basis. A condominium unit is generally worth more than a rental unit, but, the point, is it’s a really a matter of what the equity wants and what the market is saying.

We have a friendly competitor that recently completed a condominium building on Vernon Street and they’re having a really high velocity of sales. We just finished an apartment rental two blocks from there and we rented out all our units in less than a month. There are strong market indications for both. We thought we’d start to see the rental ceiling – what’s the highest we can rent these units for – and we haven’t seen it…With the inventory higher now than it was two years ago, people have a choice. If you’re building something in a bad neighborhood or an undeveloped neighborhood or uncharted territory, I think you’re going to have problems. The only time you didn’t have problems was when supply and demand were so imbalanced that people were writing contracts just based on paper plans…We’re certainly a lot closer to reality today than we were three years ago. Three years ago, it was more important what the appetizers at the opening party were than how people wrote  contracts.

contracts.

With a well located property, you can sell condominiums today. We’re just over the last few months, after two years of not even mentioning the word condominium, I actually had a meeting with an equity partner who said, “We’re not afraid of condos. If you show that you think it’ll work, we’ll do condos.” And I think the market is saying just that.

Does that mean we’ll being seeing more from-scratch, new development from UIP in the future?

We’re just starting to look at ground-up construction. We’re starting to look at developable property that we stopped looking at for a year or so - some as rental, some as condo. For a while, you couldn’t buy developable land for a price that you could rent at. Seller anticipations are starting to come into line with buyer expectations. There was that time when if you had a vacant building for sale, it was a hundred grand a year because it was assumed you’d do a condo and sell it out at three hundred grand a year…Now you got the guys that bought the buildings for a hundred, paid a little more money to get rid of the last two or three tenants…carried it for a year and they now have a vacant building – with a big fat tax bill, a nasty interest carry cost each month and nobody that is willing to finance a condominium.

Ok, so go rental? But if you’re on 10th Street, NW, an area that’s not supporting $2000 or $3000 a month rentals, how are you going take a hundred grand a unit, spend another seventy grand to renovate it and then rent it for $1200 a month? You’re losing money, so no one’s going to finance that.

There’s a lot of that type of property out there and that’s the type of property that we’ve been looking a lot at lately. There a lot of distressed owners – I won’t call them sellers yet – and they’re trying to figure out how to get out.

Given the tumultuous state people like that have found themselves in, what advice would you give to fellow DC area developers?

Where do have to be these days? DC is faring a lot a better than other areas these days, but investors don’t want to invest in DC real estate unless...you can assure them going in. I don’t see much stuff being sold for less than seven (cap rate). Maybe some AAA, pension quality development, like Mass Court, will go…but there’s not a lot of that kind of product out there. But if you’re talking about the kind of stuff that we buy – 20, 30, 40-unit buildings and small retail stuff – you’d better be at an eight cap.

[Look at] the 14th Street corridor or U Street or Adams Morgan. Christ, look at 18th Street and the vacancy right here in Cleveland Park. You’d better have a pretty good deal – a good buy, a good tenant and reasonable cap rate – if you’re getting into a small retail or small apartment building. And the interesting thing is that’s what we like to do. We like to find that opportunity.

With that in mind, what’s next for UIP in over the course of the coming year?

I see us moving forward with a very aggressive and very prolific acquisition strategy. Last year, we acquired some $60 odd million worth of real estate and bought five buildings with our equity partners. This year, we’ll be closing on two properties over the next couple weeks. We sold one or two earlier this year, which was opportunistic and advantageous…I see us making between half a dozen and dozen acquisitions over the next six to eight months.

us making between half a dozen and dozen acquisitions over the next six to eight months.

I’ve got a stack of potential properties. We’ve got a couple deals that are small retail, a couple deals that are small residential, we have a couple big, multi-hundred unit deals and a couple that are potential bank deals. And they’re all in DC. We own property in PG County – Hyattsville, Riverdale – and we are good at managing those garden-style walk-ups as well. We own a bunch of that and we’re looking a lot of it too, but I’d say that’s probably 20% of what we do. The 80% of what we look at is DC, from Southeast to Northwest, and distressed owner deals, bank deals, failed condo associations, failed tenant associations and failed development plans. We’re looking at a lot of that.

We’re looking at some properties that are owned by non-District headquartered companies. There are a lot of larger commercial real estate companies that got into the District and are now trying to get out. They hate the District, they hate rent control, they hate TOPA. We don’t love rent control either, but we’re damn good at it and we’ve been doing it for ten years.