LCOR

LCOR plans to break ground before the end of the year

on its third building - a 19-story, 341-unit apartment - within its recently enhanced

North Bethesda Center. Construction of the residential building, the "Aurora", will commence before the end of the year, confirms LCOR's vice president

Mike Smith.

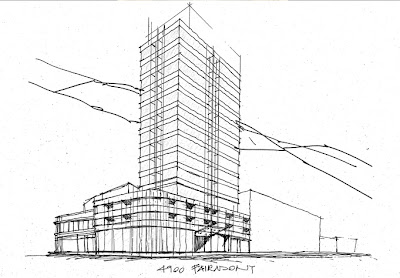

JBG is also looking to begin construction on its own North Bethesda project -

North Bethesda Market II (NoBe II, rendering to the right) - shortly after the first of the year. JBG's 4.4-acre site plan was submitted on August 24th and is now under review. JBG development executive

Greg Trimmer indicated that the developer is just waiting on the county. "We are cautiously optimistic we will get full site approval early in 2012, and plan to begin construction immediately [after approval]."

NoBe II is located north of JBG's North Bethesda Market; there could be a III and IV as JBG owns more land to the south and west of the two sites, but for now, NoBe II is its sole focus in the area. NoBe II will be completed in one phase, taking 2-to-3 years, said Trimmer.

Meanwhile, LCOR's focus for the moment, the Aurora (rendering below), was designed by

WDG, and will be built by

BE&K; the building's site plan hearing will be held on the 22nd.

Both LCOR and JBG tacked on significant density to their North Bethesda projects in the past year, after

the White Flint Sector Master Plan was passed by the Montgomery County Council in March of 2010.

Due to the increased zoning envelope permitted by the new White Flint Sector Plan, LCOR upped the square footage of planned construction on its 32-acre site by 40 percent: from 2.7 to 4.5 million square feet. JBG did the same, also increasing its F.A.R by 40 percent: from 2.4 to 4.0.

Revisions to LCOR's development have been a joint effort, having partnered with

FX Fowle earlier this year. FX Fowle was brought on to assist with creating a new, enhanced vision for North Bethesda Center and give it a "fresh look," said Smith.

The enhanced North Bethesda Center plan by LCOR and FX Fowle is for approximately 1.4 m s.f. of office, 310,000 s.f. of retail, 2.4 m s.f of residential, a 350,000 s.f. hotel, and a 15,000 s.f. library. Initial plans by LCOR were to construct eight buildings on site, however Smith said that now the development team aims for "up to 10 high-rise buildings for the property." A Site Plan for 7.4 acres (3 parcels) of the development was submitted on July 29th and is now under review.

Both Trimmer and Smith applauded the foresight of Montgomery County in passing the new Sector Plan last year. Trimmer also gave his company, JBG, a nod, when questioned whether creativity was more apt to flourish on projects located outside of the District; Trimmer said, "I have to credit JBG. We've made a distinct strategic decision to increase the distinctiveness of our architecture and differentiate our projects."

What Trimmer refers to at the moment, North Bethesda Market II (pictured above), was designed by

Studios Architecture and is comprised of a "striking" 339-unit residential tower (300-feet tall,

surpassing its own accomplishment to the south), a 6-story office building, theater, restaurant, two retail spaces and a public plaza.

Other developers with investments in the area, and looking to go dense are: Federal Realty, with its 24-acre

Mid-Pike Plaza (Site Plan for 16.3 acres was submitted on August 3rd) and Promark, with its 11-acre

North Bethesda Gateway (no Site Plan submitted yet).

In January of this year, the Montgomery County Planning Board approved the sketch plans for all three of the aforementioned projects: North Bethesda Market II, North Bethesda Gateway and Mid-Pike Plaza. The sketch plan submission is a relatively new step in the approval process (not as exciting for developers) that came with the new White Flint Sector Plan.

Trimmer added, "White Flint is a very good development opportunity; it has strong existing amenities and a large portion of underutilized land."

Another reason developers might eye the North Bethesda area is the 10-percent commercial property tax increase (part of the new Sector Plan) that will help finance an estimated $208 million in construction (and infrastructure improvements) during its lifespan. Last December, Montgomery County officials projected that new growth in the White Flint area could bring in as much as $6.8 billion.

update: Greg Trimmer with JBG, not Trimmen

Washington D.C. real estate development news

JBG Companies began construction on Rosslyn Commons exactly one year ago tomorrow. The Rosslyn apartment project will include two apartment buildings, the Sedona and the Slate, and 25 townhouses, with 55 units of subsidized housing. Despite a catastrophic wall collapse during excavation,

JBG Companies began construction on Rosslyn Commons exactly one year ago tomorrow. The Rosslyn apartment project will include two apartment buildings, the Sedona and the Slate, and 25 townhouses, with 55 units of subsidized housing. Despite a catastrophic wall collapse during excavation,  digging is now complete and general contractor Clark Construction is now building up. Both apartment buildings are expected to be LEED Silver Certified, and both residential towers will include a rooftop pool and rooftop fitness center. Bethesda-based Architects Collaborative designed the building.

digging is now complete and general contractor Clark Construction is now building up. Both apartment buildings are expected to be LEED Silver Certified, and both residential towers will include a rooftop pool and rooftop fitness center. Bethesda-based Architects Collaborative designed the building.

Arlington, VA real estate development news

Arlington, VA real estate development news

The Woodmont Triangle area was once, in attorney Bob Dalrymple's words, “ground zero not long ago,” but much of the energy has moved southwards in the past several years. A recent zoning plan amendment was the city's first attempt at revitalizing the area, and just across Fairmont is

The Woodmont Triangle area was once, in attorney Bob Dalrymple's words, “ground zero not long ago,” but much of the energy has moved southwards in the past several years. A recent zoning plan amendment was the city's first attempt at revitalizing the area, and just across Fairmont is

The $2 billion, 2.5 million-square-foot project, dubbed “The Wharf,” takes its cues from

The $2 billion, 2.5 million-square-foot project, dubbed “The Wharf,” takes its cues from

construction

construction

organized whole.

organized whole.