As the founder and CEO of the

Neighborhood Development Company (NDC),

Adrian G. Washington has overseen numerous development initiatives in the District with a primary focus on boutique condominiums and affordable housing in Columbia Heights and along a resurgent Georgia Avenue corridor. In between working on a current slate of projects that includes the

Residences at Georgia Avenue, the

Heights on Georgia Avenue and a proposal for the mixed-income redevelopment of the

Park Morton public housing complex, Mr. Washington spoke with

DCmud about the state of development in the District of Columbia, the challenges of affordable housing and what the future of the residential market.

Can you give us an overview of the company?

I’ve been doing this for about twenty years. I started out as basic as it gets - rehabbing brownstones – and moved up from there. Then, I worked for a big corporate real estate company called the

National Housing Partnership and we did a lot of affordable housing stuff. I started NDC about ten years ago by doing really the same sorts of things – rehabbing brownstones. By the next year, we were doing 4-unit buildings, then 10-unit buildings and it sort of just got bigger and bigger.

It really kind of took off about five years ago. I brought in my partner here and a couple of junior partners, a couple of vice presidents who really brought it up to a professional level. We started doing bigger projects. We were lucky to be on teams that got selected to do

CityVista and the old Convention Center site, now called

City Center. We really kind of rode the condo boom when it was hot; we had a lot of really cool boutique projects. So it started out focusing on Columbia Heights because we’re always emerging neighborhood focused. When Columbia Heights became more established, we sort of shifted it.

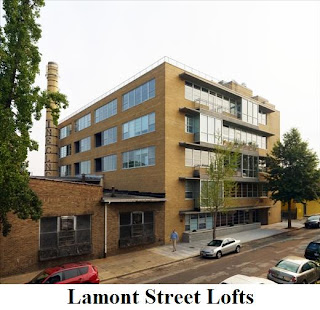

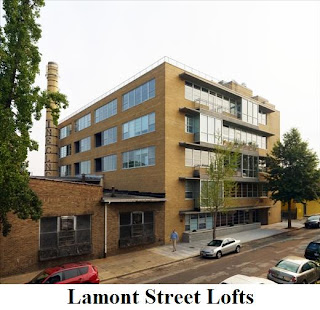

So for our last projects, we’ve done a lot of stuff up and down Georgia Avenue – projects like the

Lofts at Brightwood and

Lamont Street Lofts. We’ve also done some affordable rental projects like the Residences at Georgia Avenue. As the economy shifted, we started doing more affordable rental projects. Our Heights at Georgia Avenue project will be almost like a sister project – same size, same kind of concept with affordable housing on top and retail on the ground floor. Then we proposed on the Park Morton site and we’ll also be proposing on two of the DC school sites. We’ve teamed with

EYA on the

Hines School site and with

Equity Residential on the

Stevens School site.

Indeed, most of your new construction seems to be focused on Georgia Avenue. Are you still bullish on the area?

We hope so. We like it. We’re headquartered here and I live about five minutes away. We’ve always been focused on this area and we just saw it as the next “cool neighborhood.” You have Columbia Heights to the east and with Georgia being a Great Street, the city’s been really interested in what we’re doing and certainly helped out on a lot of things. We’ll be coordinating with them for some of the infrastructure improvements with Great Streets.

It’s a really great transportation corridor. It’s got some good parcels that are available and, particularly at the start, there were some great industrial buildings that you could convert to lofts. There's not as much now, but it’s a great area and we kind of adopted it as our backyard. We really wanted to be focused on particular neighborhoods, which is where we are.

How does the current state of the market affect a company that’s primarily focused on affordable housing?

I think it’s been good and bad. When things started getting tougher, most people - me included – said affordable housing financing is not going to be affected by the credit crisis. Well, in fact, it has. The most popular mechanism for financing affordable housing is the low income housing tax credit, where essentially you get credits that allow companies to reduce their taxes. Well, a lot fewer companies have taxable gains these days, so the market for that – while it hasn’t crashed – has declined considerably.

Also, the District a lot of times provided gap financing. A lot of that comes from the Housing Production Trust Fund that is funded by sale and recordation taxes. At the same time, the gaps have gotten bigger because construction costs went up and land values went up. The District used to be fairly flush and now they’re pretty tight. That’s been a little challenging, but the good thing is that the demand is still there. Land prices are starting to retract a little bit and construction costs are starting to mitigate. So it’s much tougher, just like private development is much tougher.

But I think DC is really strong market with basic fundamentals like what you can rent things for and demand. I really haven’t seen things as bad yet as I read in the papers and I’m optimistic because demand for things like condos and rentals really haven’t declined as much as the headlines suggest.

One crucial element of development is retail. CityVista, of course, has a Safeway and your newly completed building, the Residences at Georgia Avenue, is planned to include a Yes! Organic Market. How do you go about making neighborhoods once thought undesirable attractive to retailers?

Those were two very different cases. In terms of CityVista,

Safeway was part of the team right from the beginning. Actually, before we became part of the team, Safeway and

Lowe Enterprises, our partners, were already linked to that project. Safeway saw it as a great place to put a new urban model Safeway.

The thing with

Yes! Organic is that we approached them very early on. We didn’t have a broker or anything. They just saw it as a great location. We had some personal connections with

Gary Cha, the head of the company, and, as matter of fact, he liked it much that he wanted to buy it because he saw the potential of the neighborhood and said, “I want to get in on the ground floor.”

That’s how we’ve done it. We had the

Meridian Restaurant at our Lofts at Brightwood project and it was the same type of thing – a really entrepreneurial retailer that was willing to take a chance and invest in the neighborhood in the same way we were. That’s how we traditionally work – not through brokerage channels, but with retailers who’ve really gotten it and want to get in early on a project and help design the project to meet their specifications. It sort of goes together.

At this point, it’s safe to say that CityVista has been a success, while other projects in the immediate area have stumbled. What would you chalk that up to?

It’s funny because we just had a case study that

ULI did and they put together all the people –developers, contractors, lawyers and architects. One of the things that we talked about was doing a true mixed-use project – some condos, some apartments and retail. It’s really hard from a construction standpoint, from a legal standpoint, from an architectural standpoint, but if you get right and you get the right mix…synergy is a corny term, but it really applies to this.

We got this great Safeway, we got

Busboys and Poets and we have a real mix of retailers at the base, all of which people really want. These kind of lifestyle-type things help it be a place where people really want to be. NoMa is still kind of an emerging neighborhood and people want to feel like they have a sense of community – a place where they can live, they go downstairs to shop, they can go out to eat, they can go to go the gym. And not just a little in-house gym, but a really cool gym like

Results.

It’s a really cool place and what we’ve seen is that it’s drawn people from all over. You think it would be people who live in different parts of DC, but we have people from Prince George’s County and Virginia. It’s just been a nice sort of synergy and I think the rental component energizes the condo component and the condo component energizes the retail component and vice versa. And I think it’s priced right. It’s not entry-level pricing, but it’s not super-luxury pricing either and a lot of people can afford it. We knew we were going to sell like that.

NDC has a record of vying for some prominent District issued RFPs, including Park Morton, CityVista and 5th and I. How would you characterize your relationship with the Fenty administration and the Office of the Deputy Mayor for Planning and Economic Development?

I’m not an insider or anything, but I value and appreciate what they’re doing and I’d like to think that they feel the same about us. I feel that our goals converge. They’re interested in developing Georgia Avenue and we are too. They’re interested in promoting local businesses and I live in the city, I work in the city and I hire people in the city. It’s matter of being on the same page and understanding their challenges.

For me, having been inside the government at one time, I understand what it’s like to be on the other side of the table - the challenges that you have from a political perspective and from a legal perspective. A lot of times, you go through these long agreements with people and can seem like, “Why are they asking for that? It makes no sense.” Having been on the other side of the table, I understand that they have to get certain things through certain offices and fiscal years and so on. Having spent a bit of time in their shoes helps me understand what their hot buttons are and what’s important. That helps the negotiation process.

The important thing is that we share the same goals. We want improve neighborhoods. We want to work with the community. Like most developers, we feel that we have to reflect what’s going on and what people are looking for.

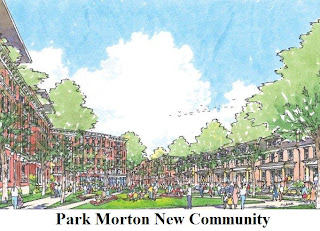

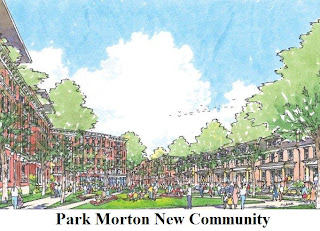

Are there any details that you can share about your proposal for the redevelopment of Park Morton?

The first thing that I really want to emphasize is that we’ve teamed with a really great partner. They're called Community Builders. They’re Boston-based, but they have a DC office. They’re really the leading non-profit developer in the country. They’ve done over 20,000 units in terms of projects. They really specialize in these sorts of difficult public housing transformations. They have a great human capital program and do things like job training, education and public safety – things that affordable housing demands. Our team, with our local knowledge and our skill, is a great combination.

Essentially, we stuck pretty close to the plan that was developed when we were part of the task force that designed the original Park Morton plan that was in the RFP submission. They’re looking for a three-phase plan – roughly a third, a third, a third - that will provide homes for all the current people who are there and then mix them up with moderate income and market rate. It’s, give or take, 500 units of housing.

We’ll be demolishing this area [along Park Road] for Phase I and building a total of 195 units. We’ll have [a separate] building dedicated to senior citizens and mixed-income units. Prior to demolition, we would provide for the relocation of families that are in there now and put them in units in and around the area, so they could stay in the neighborhood.

We’d then demolish the [second area along Morton Street] and move people into the first phase, along with new people from outside the community and build another roughly 250 units. Then, finally the third [along Lamont Street] would be building condominiums. By that point, we think the neighborhood will have improved, the market will have improved and that it would a great place to do a condominium building.

Many owners of undeveloped property are now caught between inability to get financing and maturity default. How is NDC positioned to make it through the next two or so years?

I think we’re well positioned. We’re either lucky or smart. I’m happy to take either one. We’ve done condo projects over the years and about two years ago, we began to sort of feel something in the air. Four years ago, if you built something, people were lining up. As far as two years ago, things began to slow down and we decided to decrease our exposure to condos. We did a couple of projects, but they were very value priced and we were able to sell out of those. Right now, we have zero exposure to condos.

Our project across the street, the Residences at Georgia Avenue, is a moderate income rental. We’re in lease up now and we’re getting tons of responses, so we feel very good about how that project is going to perform. The Heights on Georgia Avenue that’s basically across the street from Park Morton, we just got through with PUD and we’re just looking for financing now. Again, we think we’ve created a product that’s moderately priced and we’re pretty optimistic that we’ll get financing for that. We think that we’re in a very good place. We’re lucky to be part of CityVista that, amidst all the problems, is performing well. We’re well-positioned and I think it’s a great time to be a developer. A lot of newcomers and weaker competitors will be going away. It’s more challenging – you need more creativity – but that’s kind of cool.

Is it possible to be profitable selling new construction there in this environment?

I think so. It has to be the right place and the right design. And one of the really crazy but cool things is that things change so quickly. Our focus has been on the kind of building - it’s called podium style - that has first floor retail with four or five stories of residential above it. It’s a stick-built product. What happened in the last few years is that the delta between concrete buildings and stick-built really expanded. This was kind of a nice sweet spot in terms of building a building that’s six-stories high, but the cost per square foot was a lot low

er. That was the threshold and, if you wanted to go any higher than that, you’d have to go with concrete. We really looked at this as model for the Heights and Park Morton and we’ve seen prices for this come down. What we don’t know is if concrete construction is going to come back down and become much more competitive.

You’ve got to moderate, just from a supply and demand perspective – not just in the US, but around the world. A lot of stuff is clearly not going to get built. Commodity prices, concrete construction, oil and gas, steel – all that’s come down and the demand for labor has come down as well.

Do you see NDC starting any market-rate condominium projects in the near future?

Oh yeah, absolutely. Whether you’re condo or rental, I think that DC is great place to live. I think in terms of a competitive advantage, with the new administration and the Stimulus Package, that the city is becoming more in demand. I liked the city before the market went down and I like it even more now. I think that supply and demand is going to come back into balance. We’re seeing things like the month’s inventory start to come down. Real estate is cyclical. We had a particularly strong up cycle and now we’ve had a particularly strong down cycle, but it’s going to come back.

Just in terms of how long it takes to do things, if you look at the demand, I think the trade-up buyer has kind of decreased a little bit and speculative investment buyer has gone away completely. But that first-time buyer and the price point from three to five hundred thousand has pretty much stayed there.

But nothing’s getting built. Nobody, for any kind of project of any significant size, is starting. There’s nothing in the pipeline now and the way these projects work is that if you’re not in the pipeline now, you’re not going to deliver for at least three years – more like four or five. As the economy straightens itself out and demand is solid and starts to increase, the supply is going to be way low. Things that will be delivering in two, three or four years, I think there will be a great market for. We could easily do a boutique building of under a hundred units in that time frame. I’m really bullish on that.

Washington DC commercial real estate news

As the founder and CEO of the Neighborhood Development Company (NDC), Adrian G. Washington has overseen numerous development initiatives in the District with a primary focus on boutique condominiums and affordable housing in Columbia Heights and along a resurgent Georgia Avenue corridor. In between working on a current slate of projects that includes the Residences at Georgia Avenue, the Heights on Georgia Avenue and a proposal for the mixed-income redevelopment of the Park Morton public housing complex, Mr. Washington spoke with DCmud about the state of development in the District of Columbia, the challenges of affordable housing and what the future of the residential market.

As the founder and CEO of the Neighborhood Development Company (NDC), Adrian G. Washington has overseen numerous development initiatives in the District with a primary focus on boutique condominiums and affordable housing in Columbia Heights and along a resurgent Georgia Avenue corridor. In between working on a current slate of projects that includes the Residences at Georgia Avenue, the Heights on Georgia Avenue and a proposal for the mixed-income redevelopment of the Park Morton public housing complex, Mr. Washington spoke with DCmud about the state of development in the District of Columbia, the challenges of affordable housing and what the future of the residential market.  It really kind of took off about five years ago. I brought in my partner here and a couple of junior partners, a couple of vice presidents who really brought it up to a professional level. We started doing bigger projects. We were lucky to be on teams that got selected to do CityVista and the old Convention Center site, now called City Center. We really kind of rode the condo boom when it was hot; we had a lot of really cool boutique projects. So it started out focusing on Columbia Heights because we’re always emerging neighborhood focused. When Columbia Heights became more established, we sort of shifted it.

So for our last projects, we’ve done a lot of stuff up and down Georgia Avenue – projects like the Lofts at Brightwood and Lamont Street Lofts. We’ve also done some affordable rental projects like the Residences at Georgia Avenue. As the economy shifted, we started doing more affordable rental projects. Our Heights at Georgia Avenue project will be almost like a sister project – same size, same kind of concept with affordable housing on top and retail on the ground floor. Then we proposed on the Park Morton site and we’ll also be proposing on two of the DC school sites. We’ve teamed with EYA on the Hines School site and with Equity Residential on the Stevens School site.

It really kind of took off about five years ago. I brought in my partner here and a couple of junior partners, a couple of vice presidents who really brought it up to a professional level. We started doing bigger projects. We were lucky to be on teams that got selected to do CityVista and the old Convention Center site, now called City Center. We really kind of rode the condo boom when it was hot; we had a lot of really cool boutique projects. So it started out focusing on Columbia Heights because we’re always emerging neighborhood focused. When Columbia Heights became more established, we sort of shifted it.

So for our last projects, we’ve done a lot of stuff up and down Georgia Avenue – projects like the Lofts at Brightwood and Lamont Street Lofts. We’ve also done some affordable rental projects like the Residences at Georgia Avenue. As the economy shifted, we started doing more affordable rental projects. Our Heights at Georgia Avenue project will be almost like a sister project – same size, same kind of concept with affordable housing on top and retail on the ground floor. Then we proposed on the Park Morton site and we’ll also be proposing on two of the DC school sites. We’ve teamed with EYA on the Hines School site and with Equity Residential on the Stevens School site.  Those were two very different cases. In terms of CityVista, Safeway was part of the team right from the beginning. Actually, before we became part of the team, Safeway and Lowe Enterprises, our partners, were already linked to that project. Safeway saw it as a great place to put a new urban model Safeway.

The thing with Yes! Organic is that we approached them very early on. We didn’t have a broker or anything. They just saw it as a great location. We had some personal connections with Gary Cha, the head of the company, and, as matter of fact, he liked it much that he wanted to buy it because he saw the potential of the neighborhood and said, “I want to get in on the ground floor.”

That’s how we’ve done it. We had the Meridian Restaurant at our Lofts at Brightwood project and it was the same type of thing – a really entrepreneurial retailer that was willing to take a chance and invest in the neighborhood in the same way we were. That’s how we traditionally work – not through brokerage channels, but with retailers who’ve really gotten it and want to get in early on a project and help design the project to meet their specifications. It sort of goes together.

Those were two very different cases. In terms of CityVista, Safeway was part of the team right from the beginning. Actually, before we became part of the team, Safeway and Lowe Enterprises, our partners, were already linked to that project. Safeway saw it as a great place to put a new urban model Safeway.

The thing with Yes! Organic is that we approached them very early on. We didn’t have a broker or anything. They just saw it as a great location. We had some personal connections with Gary Cha, the head of the company, and, as matter of fact, he liked it much that he wanted to buy it because he saw the potential of the neighborhood and said, “I want to get in on the ground floor.”

That’s how we’ve done it. We had the Meridian Restaurant at our Lofts at Brightwood project and it was the same type of thing – a really entrepreneurial retailer that was willing to take a chance and invest in the neighborhood in the same way we were. That’s how we traditionally work – not through brokerage channels, but with retailers who’ve really gotten it and want to get in early on a project and help design the project to meet their specifications. It sort of goes together.  We got this great Safeway, we got Busboys and Poets and we have a real mix of retailers at the base, all of which people really want. These kind of lifestyle-type things help it be a place where people really want to be. NoMa is still kind of an emerging neighborhood and people want to feel like they have a sense of community – a place where they can live, they go downstairs to shop, they can go out to eat, they can go to go the gym. And not just a little in-house gym, but a really cool gym like Results.

It’s a really cool place and what we’ve seen is that it’s drawn people from all over. You think it would be people who live in different parts of DC, but we have people from Prince George’s County and Virginia. It’s just been a nice sort of synergy and I think the rental component energizes the condo component and the condo component energizes the retail component and vice versa. And I think it’s priced right. It’s not entry-level pricing, but it’s not super-luxury pricing either and a lot of people can afford it. We knew we were going to sell like that.

We got this great Safeway, we got Busboys and Poets and we have a real mix of retailers at the base, all of which people really want. These kind of lifestyle-type things help it be a place where people really want to be. NoMa is still kind of an emerging neighborhood and people want to feel like they have a sense of community – a place where they can live, they go downstairs to shop, they can go out to eat, they can go to go the gym. And not just a little in-house gym, but a really cool gym like Results.

It’s a really cool place and what we’ve seen is that it’s drawn people from all over. You think it would be people who live in different parts of DC, but we have people from Prince George’s County and Virginia. It’s just been a nice sort of synergy and I think the rental component energizes the condo component and the condo component energizes the retail component and vice versa. And I think it’s priced right. It’s not entry-level pricing, but it’s not super-luxury pricing either and a lot of people can afford it. We knew we were going to sell like that. er. That was the threshold and, if you wanted to go any higher than that, you’d have to go with concrete. We really looked at this as model for the Heights and Park Morton and we’ve seen prices for this come down. What we don’t know is if concrete construction is going to come back down and become much more competitive.

You’ve got to moderate, just from a supply and demand perspective – not just in the US, but around the world. A lot of stuff is clearly not going to get built. Commodity prices, concrete construction, oil and gas, steel – all that’s come down and the demand for labor has come down as well.

er. That was the threshold and, if you wanted to go any higher than that, you’d have to go with concrete. We really looked at this as model for the Heights and Park Morton and we’ve seen prices for this come down. What we don’t know is if concrete construction is going to come back down and become much more competitive.

You’ve got to moderate, just from a supply and demand perspective – not just in the US, but around the world. A lot of stuff is clearly not going to get built. Commodity prices, concrete construction, oil and gas, steel – all that’s come down and the demand for labor has come down as well.

Following January approvals from the

Following January approvals from the

.jpg)