decided it was time to catch up with someone that has been through the bust-boom cycle of residential development before. We spoke with

, and a member of the Mt. Vernon Triangle CID. Jeff shared his thoughts on development in the Washington DC area, the regulatory system, and good prospects for future development.

DCMud: First, tell us about Prospect Diversified.

JM: We are investors in multi-family properties - both value add and ground-up development opportunities. Transactions in that market, however, are sparse. Sellers of property still expect that it’s worth what it was in 2006 during the condo conversion and development boom. Today’s economic and underwriting conditions have eroded values considerably since then, but sellers are having a hard time shaking that historic context.

DCMud: Can you detail some of your past firms and projects?

JM: I was with JBG from 2000 to 2005 and with Lowe Enterprises for about a year and a half. Then I joined Trammel Crow from October of 2007 to October of 2008. When I started with JBG they were just starting to focus on residential development in the urban core. They identified six vacant sites, and I'm stressing vacant because there was no displacement of residents required to provide this very significant addition to the housing stock. There were two in the West End/Foggy Bottom, and then 1210 Mass, 13th and N, 9th and E which is now a condo called the Artisan, and a site at 6th and G called the Cosmopolitan. They were all expected to be rental apartments but today only two remains rental – the rest went condo. Many of those deals were done in joint venture with Equity Residential.

DCMud: What's your prediction for how residential development is going to shake out in DC?

JM: On the financing side, many of the larger construction lenders are out of the residential business. Some of the local banks will actually look at these deals, but they’re just not penciling right now because cap rates have risen, rents are flat, and risk capital is demanding higher returns. The condominium development market is dead, so it’s only rental properties that we’re looking at, particularly stabilized buildings in need of repositioning and renovation. We have offers being considered on those kinds of buildings, but, to date, we’ve not closed on anything. We’re looking at areas where there is already a well established and well understood market – partially because the art of financing is the storytelling that goes along with it, these neighborhoods include Columbia Heights, 14th Street, U Street, and as far east as 9th Street by Howard University. These are areas that, when the market was growing, you could see residential migration in that direction. Now that the market’s flat, it’s probably where development is going to continue once things improve.

It’s helpful to note that DC has a lot of unusual characteristics - the entitlement process, layered on top of the historic review process, layered on top of a tenants’ rights process. I think having sense of all these elements and knowing the players helps in specializing in the DC market.

DCMud: As a developer, what is your greatest frustration of building within DC's rules?

JM: Mandatory inclusionary zoning is legislation that requires, in many newly constructed buildings, that a portion of the units to be affordable. The City gives the developer some additional density to offset the additional cost for this requirement, but the affordable housing they’re asking for is not really workforce housing. It’s housing for folks at the lower end of the income spectrum and the rents are accordingly low. But sometimes giving a builder more density is not always a plus because he might have to change to a more expensive construction type, and because the city has certain height restrictions, sometimes the envelope in which you’re building can’t actually take more density. Given the huge economic burden of the affordable housing and at the legislated income levels, the extra density rarely provides a dollar for dollar offset for the requirement.

DCMud: But some would say it is worth the trade-off.

JM: Affordable housing is going to be an important goal for any urban municipality. But it needs to be balanced against the unintended consequences. The total number of affordable units the legislation might actually produce is tiny when compared to the existing affordable housing stock in the city. But the impediment to production of market rate housing, due to the legislation’s material impact to a project’s economics, means fewer income tax-paying, urban consumers that DC so desperately needs to remain vital.

Everyone thinks that developers are making money hand over fist and we’re not. We’re making risk-adjusted returns for the capital invested with us, and right now, we can’t even make those returns because of the current economic conditions. That means it’s going to take that much longer for the urban renewal to continue. We’ve done a pretty good job as a real estate business community – on the commercial, retail and residential sides – in taking areas of the city that were underutilized, and without displacing anyone, bringing jobs and residents to these neighborhoods. The Mount Vernon Triangle is just one example.

DCMud: Speaking of the Mount Vernon Triangle, you serve on the board of the area's Community Improvement District. You've worked on some prominent projects in the neighborhood, but what is the CID up to these days and what is the outlook for the MVT?

JM: CityVista is the biggest one that one I’ve worked on – 650 units, 100,000 square feet of retail with a 55,000 square foot Safeway in it. The Safeway is doing very well and, as Chairman of the Mount Vernon Triangle CID…I follow closely what’s going on there. The CID has played a crucial role in helping bring additional services and attention to this area that only a few years back was mostly a series of parking lots. The CID is focused now on providing safety and beautification services to the area, and with the help of several grants we’ve been able to upgrade the landscaping in the Triangle. As more development delivers in the Triangle, the CID will be able to provide a growing set of services.

I was involved in the development of a building for JBG called 555 Mass and, when I moved to Lowe Enterprises, I went to work right around the corner on CityVista, so I’ve been involved with the neigborhood’s revitalization for nearly ten years. CityVista has done remarkably well considering the climate we’re in right now. I understand that the lease up of the rental apartments has been brisk. The condos sold well out of the box in 2006 and then hit the headwinds, but, even so, it’s been the fastest selling project in DC.

DCMud: Of all the three jurisdictions included under the umbrella of the “the metro area,” which one do you think holds the most promise as the market begins to rebound?

JM: I really like Arlington. I can’t think of another well-established and semi-urban place that is as open-minded and thoughtful while also understanding the economic drivers of our business. They’re pro-growth and smart growth. The way they’ve been able to create density around every Metro stop is something that DC hasn’t really gotten its arms around yet. In Arlington, it’s a well-understood entitlement process and you know you’re going to have a guaranteed market…Anything along that Metro line is golden.

But, the District is good because there is no entitlement process if you are building according to the existing zoning. If you have no historic issues to deal with, you can essentially apply for a permit and start building. You don’t have anyone telling you what exterior stone to pick and commenting on architectural details like rooflines and window styles, as is the case in the remaining surrounding jurisdictions. Quality buildings begin with quality design by architects, not community activists, city planners, and elected officials.

DCMud: With the market shutting down, there are a lot of developers that are no longer affiliated with a large firm. What's it like going out on your own, and what would you recommend to others?

JM: I think our business is in a transition...when I first got into real estate in the early 90’s the majority of the players were smaller, entrepreneurial groups capitalized with third party joint venture partners. It transitioned to fund-based and institutional capital closer in form to investment bank or private equity funds. That transition sucked some of the excitement and entrepreneurial benefit from the development process that drew so many of us to the business in the first place and replaced it with hyper-reporting, organizational charts, and group-think decision-making. Speaking for myself only, I wanted to return to the very basics of our business – identifying opportunities, selling the dream to investors, executing a plan, and harvesting returns. To the extent I am pursuing that goal I feel extremely gratified, but as I said earlier, this is a tough market to start any kind of venture.

Washington DC commercial real estate news

The Watergate Hotel went to the auction block this morning. According to Reuters, with an opening bid at $25 million, no bids were placed and PB Capital Corp. made a credit bid to wipe out all debts on the property for $25 million. This despite the $40 million the bank was owed by Monument Realty, whose financing partner on the project, Lehman brothers, went bankrupt this past fall.

The Watergate Hotel went to the auction block this morning. According to Reuters, with an opening bid at $25 million, no bids were placed and PB Capital Corp. made a credit bid to wipe out all debts on the property for $25 million. This despite the $40 million the bank was owed by Monument Realty, whose financing partner on the project, Lehman brothers, went bankrupt this past fall.

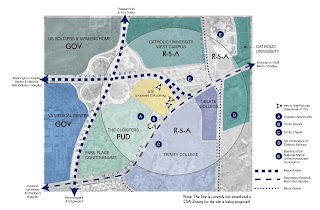

new, higher density condominium projects like 22 West, the Ritz-Carlton, and Columbia Residences. The RFP issued this morning calls for development proposals to redevelop the West End Library, fire station, and special operations police unit, all of which must continue in operation in some capacity, with the police unit likely being relocated.

The RFP was released on Friday. The District is seeking "creative proposals," due by October 2nd, with broad latitude to develop an overall plan, while (nudge nudge) taking into consideration neighbor's overall vision for the neighborhood - a plan that foresees safe, lively streets with a local retail center, and more vibrant Washington Circle, revamped to be more of a meeting place.

new, higher density condominium projects like 22 West, the Ritz-Carlton, and Columbia Residences. The RFP issued this morning calls for development proposals to redevelop the West End Library, fire station, and special operations police unit, all of which must continue in operation in some capacity, with the police unit likely being relocated.

The RFP was released on Friday. The District is seeking "creative proposals," due by October 2nd, with broad latitude to develop an overall plan, while (nudge nudge) taking into consideration neighbor's overall vision for the neighborhood - a plan that foresees safe, lively streets with a local retail center, and more vibrant Washington Circle, revamped to be more of a meeting place.