Ever since the Fenty administration took over development of the District's publicly-owned property, merging agencies and placing them under his direct supervision, it seems development of blighted blocks has been given a new urgency, even compared to that of the Williams administration - itself a great improvement over its predecessor. But despite weekly announcements from the Mayor and the Office of Planning and Economic Development, many of the projects still have to proceed through the District's infamously thick bureaucracy. But if China can cleanse its murky atmosphere in a few short months, there is cause for optimism that change is in the air here in Washington. DCMud has prepared a rundown of the largest projects now underway, properties in need of developers, and solicitations to look for in the future.

The projects listed below are still being refined. The numbers and square footage assigned to each are conceptual and are subject to change.

Projects With Developers Southwest Waterfront

Southwest Waterfront by

Hoffman Streuver will offer 539 market-rate units and 231 affordable units. The $1.5 billion project will also include 350 hotel rooms, 700,000 s.f. of office space and 280,000 s.f. of retail space. On July 15th, the DC Council approved a $198 million

TIF/PILOT package to finance park and infrastructure improvements. Groundbreaking is not expected any time soon, with construction lasting at least 6 years.

, the erroneously named project at 401 M Street, SW, will deliver 800 market-rate and 200 affordable residential units as well as 1.3 million s.f. of office space and 110,00 s.f. of retail space. Mayor Fenty joined

SW Waterfront Associates (

Forest City Wasington,

Charles E. Smith Vornado) in November to demolish the former Waterside Mall. The $800 million project will sit atop the Waterfront -SEU Metro station.

Clark Realty

Clark Realty was selected in February as Master Developer for

Poplar Point on the east side of the Anacostia. The number of residential and hotel units they will deliver has not yet been determined, however 30% of all residential units will be affordable. The District and the National Park Services held a public scoping meeting last month for the Environmental Impact Statement of the $2.5 billion project.

Center Leg Freeway on Massachusetts Ave, NW between 2nd and 3rd Streets is being developed by

Louis Dreyfus Properties into 100 market- rate and 50 affordable residential units. The $1.1. billion project will cap the exposed section of I-395, and include 2,100,000 s.f. office space and 67,000 s.f. retail space.

The McMillan Sand Filtration Site on North Capital Street and Michigan Avenue will be developed into 820 market-rate units, 351 affordable units, and a 100-room hotel by EYA. The $1 billion project will also deliver 700,000 s.f. of office space and $110,000 s.f. of retail space. The project has long been worked over, but don't make plans for moving in any time soon.

In May

In May the District reached a deal with

Hines Archstone to develop a 400-room "high-end" hotel and 100,000 s.f. of additional retail space on "Parcel B", a 53,000 s.f. plot of land that is part of the larger

CityCenter DC, the development taking up residence on the old convention center site. The entire $850 million project downtown will deliver 539 market-rate units, 135 affordable units, 476,000 s.f. of office space, and 266,000 s.f. of retail space.

On June 26th,

Marriot International,

Cooper Carry Architects and

EHT Traceries presented plans for the

Convention Center Headquarters Hotel to the

Historic Preservation Review Board. Located on the Corner of 9th Street and Massachusetts Avenue, NW, the $550 million project will deliver 1125 hotel rooms and 25,00 s.f. of retail space. Having been scaled back from its original 1400 bed facility, the project is well past its early schedule, of construction in 2007.

O Street Market at 7th Street and Georgia Avenue will be transformed into a mixed-use development that will include 550 market-rate and 80 affordable residential units by

Roadside Development. The $329 million development will replace a current Giant supermarket with a new 71,000 s.f. store and include a 200 unit hotel and 87,000 s.f. of retail space. The District reached an agreement with the developer late last month to kickstart financing. Of the dozens of projects promising to revitalize the Shaw neighborhood, this may be the first large project to actually get underway.

Skyland Shopping Center on Good Hope Road at Naylor and Alabama Avenue, SE will be developed by

Rappaport Companies and

William C. Smith Companies into a $261 million development with 155 market-rate units and 66 affordable units as well as 230,000 s.f. of retail space. When? Even an estimate will be fine.

City Vista

City Vista, which began sales in late 2005, will bring 441 condos with 138 affordable residential units to, as well as a separate apartment building, to 5th and K Streets, NW. The project will also include 130,000 s.f. of retail space and will cost $191 million. The first condominium building completed last October, the remaining condominium and the apartment building are nearly ready for occupancy.

Early this year, Fenty signed a Land Disposition Agreement with

Broadcast Center One Partners LLC, (

Ellis Development and

Four Points, LLC) that will bring African-American-owned

Radio One to the district. The $144 million

Broadcast Center One at 7th and S Streets, NW will be a mixed-use project with 135 market-rate and 45 affordable residential units as well as 96,000 s.f. of office space and 22,000 s.f. of retail space. According to Fenty's office, "the deal also sets in motion the $22 million redevelopment of the Howard Theater, a long-shuttered landmark that was the hub of black Broadway." If it gets built; the timeline remains uncertain.

Mt. Carmel (Parcel 51B) on 3rd Street, NW between K and H Streets is being developed by

MQW LLC (

Quadrangle and the

Wilkes Companies) into $130 million mixed-use project with 267 market-rate units, 67 affordable units and 90,000 s.f. office space.

Forest City Washington is responsible for the $120 million

O Street SE Redevelopment by the SE Federal Center. It will deliver 354 market-rate units, 89 affordable units and 47,000 s.f. of retail space.

The Village at Dakota Crossing

The Village at Dakota Crossing in Fort Lincoln by

Ft. Lincoln New Town Corporation will include 327 market-rate and 30 affordable units. It will cost $110 million.

Mid City Urban and

A&R Development will bring 216 market-rate and 54 affordable residential units as well as 70,000 s.f. of retail space to the area around the Rhode Island Avenue Metro station with their $105 million

Rhode Island Station project. First attempted as a condo project, developers have bowed to the market and substituted apartment buildings - at least in theory, as the project has yet to break ground.

The $100 million

Shops at Dakota Crossing on New York and South Dakota Avenue, NE will be developed by

Ft. Lincoln New Town Corporation into 29,000 s.f. of office space and 461,000 s.f. of retail space.

Lowe Enterprises and

Jack Sophie Development have long had intentions to develop Riggs Road and South Dakota Avenue, NE (

Triangle Parcel) into 208 market-rate units, 52 affordable units and 23,223 s.f. of retail to the tune of $75 million. The fate of the project is uncertain, as higher construction costs, shrinking condo prices, and more conservative lending practices - especially in low-income neighborhoods, make such projects harder to justify.

Park Place

Park Place on Georgia Avenue in Petworth will be developed by

Donatelli Development into 161 market-rate units, 32 affordable units and 16,000 s.f of retail space and will cost $60 million. Purchased by Donatelli, along with partners

Gragg & Associates, Canyon Capital Realty Advisors and Earvin 'Magic' Johnson, will be one of the few developers delivering new condos in 2009.In February, the District made a Term Sheet with

Parcel 42 Partners to develop 95 affordable housing units and 8,000 s.f. of retail space on

Parcel 42, in Shaw at 7th and Rhode Island Avenue, NW for $28 million.

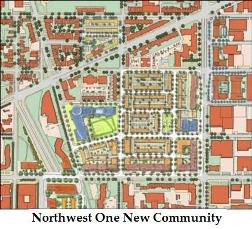

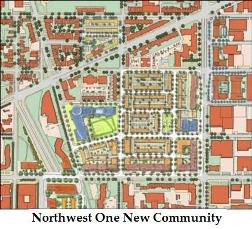

In December 2007, the District selected

William C. Smtih Companies and the

Jair Lynch Companies to develop the $700 million

Northwest One New Community that will deliver 1,600 units of housing on former NCRC parcels as well as adjacent DC-controlled and private properties in Ward 6. Located between North Capitol Street, New York Avenue, New Jersey Avenue, and K Street, the site is in an area that has "long been plagued by high crime and poverty", but is surrounded by the up-and-coming NoMa and Mt.Vernon Triangle neighborhoods. The development team, which also includes

Banneker Ventures and

CPDC (affordable housing provider), will create apartments, townhouses, and condos for all income levels as well as over 40,000 s.f. of retail and 220,000 s.f. of office space. The development will also offer a 21,000 s.f. clinic.

And further down the road...

The District issued a solicitation in early June for

Parcel 69 at 4th, 6th, and E Streets, SW. The $130 million development will be an office and hotel project along the Southwest freeway. Proposals are due by September 15th.

In May, Fenty issued an RFEI for the

Hill East Waterfront on Capitol Hill East. The District seeks a developer to create 2,100 market-rate and 900 affordable units with 2,000,000 s.f office space and 67,000 s.f. of retail space. The District anticipates a price tag of $1.1 billion for the development of the 50 acres surrounding the former DC General Hospital. Proposals are due by October 31st.

Proposals were due June 3rd for

Minnesota and Benning Road, NE Phase II. The $107 million

development will include 60 market rate, 392 affordable units and 40,000 s.f. of retail. No developer has been selected.

It is high time the District announced developer for

Fifth and I Street, NW. After proposals were submitted in March, the District widdled the teams down to the

final four including

BG, Buccini/Pollin, Potomac Investment Properties, and a group comprised of Holland Development, Donohoe Development, Spectrum Management, and Harris Development. The winning team, whenever they are announced, will create somewhere around 170 market-rate units, 30 affordable units, 100 hotel rooms and 50,000 s.f. of retail space.

Upcoming Solicitations

_rendering.jpg)

The District would like to see 1,469 market-rate and 440 affordable units in

Lincoln Heights in Ward 7 at an estimated cost of $576 million.

Barry Farm/Park Chester/Wade Road in Ward 8 will likely include 110 market and 330 affordable housing units and will cost around $550 million. The project is an effort to revitalize low-income properties in the historic Anacostia area.

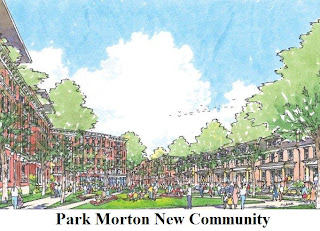

The issuance of the

Park Morton solicitation at Park Road and Georgia Avenue, NW is "imminent" according to the Mayor's office and will cost $136 million with 499 market-rate and 150 affordable units.

Axis

The District announced today its decisions on how to proceed with the first major phase of Northwest One. In an 11am press briefing, the Mayor announced that DC-based Banneker Ventures will join developer William C. Smith & Co. to build 300 units of housing in place of the vacant parking lot at the intersection of North Capitol and Patterson Streets.

The District announced today its decisions on how to proceed with the first major phase of Northwest One. In an 11am press briefing, the Mayor announced that DC-based Banneker Ventures will join developer William C. Smith & Co. to build 300 units of housing in place of the vacant parking lot at the intersection of North Capitol and Patterson Streets. Groundbreaking is now expected in "spring" of 2010, according to Mayor Adrian Fenty.

Groundbreaking is now expected in "spring" of 2010, according to Mayor Adrian Fenty. October rebuild the Strand Theater. Warrenton Group was also given a new lease on life for the Florida Avenue parcel, awarded to Banneker by WMATA in 2008 but not built out.

October rebuild the Strand Theater. Warrenton Group was also given a new lease on life for the Florida Avenue parcel, awarded to Banneker by WMATA in 2008 but not built out.

_rendering.jpg)