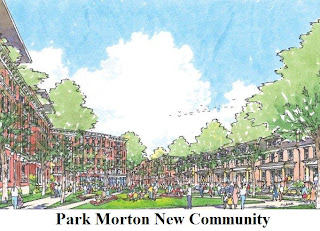

million initiative to redevelop Petworth's Park Morton public housing complex. Although currently seeking a development partner for the deal, the city has already forged ahead and outlined their intentions for the site: 317 market-rate housing units, 206 affordable housing units, a 10,000 square foot park and a new community center with green designs throughout. The mayor prefaced his comments to the press by assuring the current residents in attendance that they will be relocated to new units in the project and that "no one will be displaced."

million initiative to redevelop Petworth's Park Morton public housing complex. Although currently seeking a development partner for the deal, the city has already forged ahead and outlined their intentions for the site: 317 market-rate housing units, 206 affordable housing units, a 10,000 square foot park and a new community center with green designs throughout. The mayor prefaced his comments to the press by assuring the current residents in attendance that they will be relocated to new units in the project and that "no one will be displaced."

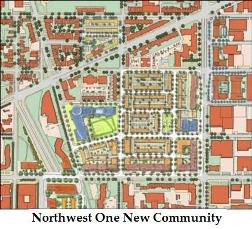

Mayor Fenty credited the New Communities Initiative established during Anthony Williams' tenure as mayor (which also includes Barry Farm and Lincoln Heights, in addition to Park Morton) as the genesis of the new development and explained how the city planned on manifesting change in an area best described as derelict and dangerous.

“It is about bricks and mortar because a lot of these projects are old. They need a lot of work and, to be honest with you, just re-doing them isn’t going  to cut it,” he said. “But its also about more than bricks and mortar. We’re also going to have health care facilities, schools, recreation centers, and job training centers here at Park Morton.”

The mayor concluded his remarks by stating, “It’s important to note that while this in-and-of-itself is an important opportunity and investment for the Georgia Avenue corridor, this is just one of the many different things that are happening.” He went on to specifically cite Donatelli Development Inc.’s $70 million, 156-unit Park Place project and neighboring $5 million retail investment, along with Jair Lynch’s 130-unit apartment complex at 3910 Georgia and the District’s own new, mixed-income development on the 3400 block (more to follow from DCMud in the coming weeks) as other in-the-works projects aimed at making area attractive to prospective residents and retailers.

to cut it,” he said. “But its also about more than bricks and mortar. We’re also going to have health care facilities, schools, recreation centers, and job training centers here at Park Morton.”

The mayor concluded his remarks by stating, “It’s important to note that while this in-and-of-itself is an important opportunity and investment for the Georgia Avenue corridor, this is just one of the many different things that are happening.” He went on to specifically cite Donatelli Development Inc.’s $70 million, 156-unit Park Place project and neighboring $5 million retail investment, along with Jair Lynch’s 130-unit apartment complex at 3910 Georgia and the District’s own new, mixed-income development on the 3400 block (more to follow from DCMud in the coming weeks) as other in-the-works projects aimed at making area attractive to prospective residents and retailers.

to cut it,” he said. “But its also about more than bricks and mortar. We’re also going to have health care facilities, schools, recreation centers, and job training centers here at Park Morton.”

The mayor concluded his remarks by stating, “It’s important to note that while this in-and-of-itself is an important opportunity and investment for the Georgia Avenue corridor, this is just one of the many different things that are happening.” He went on to specifically cite Donatelli Development Inc.’s $70 million, 156-unit Park Place project and neighboring $5 million retail investment, along with Jair Lynch’s 130-unit apartment complex at 3910 Georgia and the District’s own new, mixed-income development on the 3400 block (more to follow from DCMud in the coming weeks) as other in-the-works projects aimed at making area attractive to prospective residents and retailers.

to cut it,” he said. “But its also about more than bricks and mortar. We’re also going to have health care facilities, schools, recreation centers, and job training centers here at Park Morton.”

The mayor concluded his remarks by stating, “It’s important to note that while this in-and-of-itself is an important opportunity and investment for the Georgia Avenue corridor, this is just one of the many different things that are happening.” He went on to specifically cite Donatelli Development Inc.’s $70 million, 156-unit Park Place project and neighboring $5 million retail investment, along with Jair Lynch’s 130-unit apartment complex at 3910 Georgia and the District’s own new, mixed-income development on the 3400 block (more to follow from DCMud in the coming weeks) as other in-the-works projects aimed at making area attractive to prospective residents and retailers. Ward 1 Councilmember Jim Graham, who had introduced the initial city council resolution for the Park Morton project and led community meetings on the subject, followed Mayor Fenty’s turn at the podium. He began by reiterating the mayor’s promise that no residents would be displaced by the project and promised that the upcoming changes would result in “a much more successful and livable community than we have today.”

He also said that the District would not repeat mistakes with regard to public housing that have plagued the city for decades. “Gathering all the poor people in one neighborhood, in one building, ought not to be the preferred approach,” he said. “When we have the opportunity to create mixed-income, diverse background [housing], that is an opportunity we should not lose.” He went to specify that the new Park Morton will become a beacon of diversity in Ward 1, “without losing a single person who is here today.”

Michael Kelly, Executive Director of the DC Housing Authority (DCHA), went on to trumpet the long-term viability of a new community comprised of “low income, moderate income and market-rate people.” And sounding a bit like George Washington at the Continental Congress, Kelly referred to it as "This grand experiment," asserting that the project "is [due to the leadership] of Washington, DC, and has not been replicated anywhere else in the country.”

He also said that the District would not repeat mistakes with regard to public housing that have plagued the city for decades. “Gathering all the poor people in one neighborhood, in one building, ought not to be the preferred approach,” he said. “When we have the opportunity to create mixed-income, diverse background [housing], that is an opportunity we should not lose.” He went to specify that the new Park Morton will become a beacon of diversity in Ward 1, “without losing a single person who is here today.”

Michael Kelly, Executive Director of the DC Housing Authority (DCHA), went on to trumpet the long-term viability of a new community comprised of “low income, moderate income and market-rate people.” And sounding a bit like George Washington at the Continental Congress, Kelly referred to it as "This grand experiment," asserting that the project "is [due to the leadership] of Washington, DC, and has not been replicated anywhere else in the country.”

He also said that the District would not repeat mistakes with regard to public housing that have plagued the city for decades. “Gathering all the poor people in one neighborhood, in one building, ought not to be the preferred approach,” he said. “When we have the opportunity to create mixed-income, diverse background [housing], that is an opportunity we should not lose.” He went to specify that the new Park Morton will become a beacon of diversity in Ward 1, “without losing a single person who is here today.”

Michael Kelly, Executive Director of the DC Housing Authority (DCHA), went on to trumpet the long-term viability of a new community comprised of “low income, moderate income and market-rate people.” And sounding a bit like George Washington at the Continental Congress, Kelly referred to it as "This grand experiment," asserting that the project "is [due to the leadership] of Washington, DC, and has not been replicated anywhere else in the country.”

He also said that the District would not repeat mistakes with regard to public housing that have plagued the city for decades. “Gathering all the poor people in one neighborhood, in one building, ought not to be the preferred approach,” he said. “When we have the opportunity to create mixed-income, diverse background [housing], that is an opportunity we should not lose.” He went to specify that the new Park Morton will become a beacon of diversity in Ward 1, “without losing a single person who is here today.”

Michael Kelly, Executive Director of the DC Housing Authority (DCHA), went on to trumpet the long-term viability of a new community comprised of “low income, moderate income and market-rate people.” And sounding a bit like George Washington at the Continental Congress, Kelly referred to it as "This grand experiment," asserting that the project "is [due to the leadership] of Washington, DC, and has not been replicated anywhere else in the country.” Kelly  cited the Housing Authority’s upkeep of current Park Morton facilities, including the addition of new boilers, stairwells and security cameras as initial steps towards a better quality of living. He then went on to ask the assembled residents if such efforts had made them feel safer – and received a rousing reply of “yes.”

Following the remarks, all in attendance were led on a tour of the newly remodeled Park Morton Children’s Center. As the first example of Park Morton revitalization, Mayor Fenty inspected the new computer lab, classrooms and music rehearsal spaces that are to serve as a hub of community operations during and after construction.

BIDs for the Park Morton project are due by December 12th with final selection to occur in March.

cited the Housing Authority’s upkeep of current Park Morton facilities, including the addition of new boilers, stairwells and security cameras as initial steps towards a better quality of living. He then went on to ask the assembled residents if such efforts had made them feel safer – and received a rousing reply of “yes.”

Following the remarks, all in attendance were led on a tour of the newly remodeled Park Morton Children’s Center. As the first example of Park Morton revitalization, Mayor Fenty inspected the new computer lab, classrooms and music rehearsal spaces that are to serve as a hub of community operations during and after construction.

BIDs for the Park Morton project are due by December 12th with final selection to occur in March.

cited the Housing Authority’s upkeep of current Park Morton facilities, including the addition of new boilers, stairwells and security cameras as initial steps towards a better quality of living. He then went on to ask the assembled residents if such efforts had made them feel safer – and received a rousing reply of “yes.”

Following the remarks, all in attendance were led on a tour of the newly remodeled Park Morton Children’s Center. As the first example of Park Morton revitalization, Mayor Fenty inspected the new computer lab, classrooms and music rehearsal spaces that are to serve as a hub of community operations during and after construction.

BIDs for the Park Morton project are due by December 12th with final selection to occur in March.

cited the Housing Authority’s upkeep of current Park Morton facilities, including the addition of new boilers, stairwells and security cameras as initial steps towards a better quality of living. He then went on to ask the assembled residents if such efforts had made them feel safer – and received a rousing reply of “yes.”

Following the remarks, all in attendance were led on a tour of the newly remodeled Park Morton Children’s Center. As the first example of Park Morton revitalization, Mayor Fenty inspected the new computer lab, classrooms and music rehearsal spaces that are to serve as a hub of community operations during and after construction.

BIDs for the Park Morton project are due by December 12th with final selection to occur in March. Washington DC commercial real estate news

_rendering.jpg)