Real estate development is sometimes an agreeable collaboration, sometimes a struggle, and all too often a wordy brawl, but seldomly is it constitutionally challenging. But that may well be the case in southeast DC's

Skyland Town Center project, now in its 8th year of development. What began as a plan to redevelop a needy southeast neighborhood, a benefit most agreed was overdue, has morphed into a property rights battle that tests the U.S. Supreme Court's decisions on property rights.

Eight years ago, the

National Capital Revitalization Corporation (NCRC) began planning a makeover of the strip mall, proposing 450-500 residential units and 280,000 s.f. of retail at the intersection Alabama Avenue and Good Hope Road, an area that saw none of the rejuvenation that occurred downtown over the last decade. The District-funded NCRC recognized the spot as a bullseye to spur development, one where private industry alone might not be tempted. The choice seems apt; shuttered beauty salons accompany a check-cashing outlet, a Discount Mart offers faded displays in the window, and the mismatched storefronts are united as much by their nearly-matching green awnings as by their peeling paint and disrepair. On a warm day, car traffic is heavy but the few pedestrians seem more inclined to linger on one of the park benches in front than patronize the stores.

Promoters have a vision: "A 20-year old dream, conceived by Ward 7 residents when this 16-acre site in southeast Washington, D.C. was declared a redevelopment zone in the late 1980's...will transform a disjointed retail area with limited offerings into a cohesive, well-designed, prominent living, shopping, and gathering place." Planners

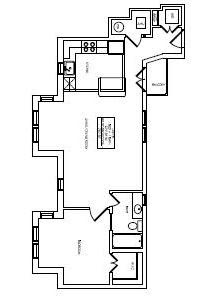

presented at a meeting to the ANC in February, promising a new retail experience for southeast: concentrated retail, multi-family residences, three above-ground parking garages, a 5-story streetfront presence, and reducing vehicular access points for less interrupted pedestrian traffic. As a bribe to locals, builders will throw several million dollars at homeowner counseling services, retail build-out subsidies, park improvements, sidewalk and road enhancements, and job preparedness.

The project was initiated during

Mayor Williams' term, but the

Fenty administration has gotten squarely behind the project, helping bring together the parties and promoting the project. The Council has even offered a $40 million Tax Increment Financing (TIF) package to provide gap financing to the team, a consortium including

Rappaport Companies,

William C. Smith & Co.,

Harrison Malone Development LLC, the

Marshall Heights Community Development Organization (MHCDO) and the

Washington East Foundation. The Feds, for their part, threw in $28m of funding to show their support. Even the ANC, which usually love development as long as its not in their district, voted to support the project.

With all the economic incentives and mutual bonhomie, what could stop such a beloved juggernaut? The people who own the land. A not-so-small detail in the rehash is that neither the development team nor the city owns most of the property; private owners (originally 15, predominantly retailers) still claim title to the land. And with concerns about displacement and the possibility that once the site is emptied developers will not have financing to build up again, owners fret that selling out means closing down, for good.

The District government is sympathetic, but not very. In view of the greater good for the area, the economic development that will ensue and tax revenue that will one day flow, District planners have opted to proceed with or without the owners' approval. In May of 2004, the District passed "emergency" legislation authorizing NCRC to use eminent domain proceedings - where the government determines and pays a fair market value and takes over the land - to acquire the 40 parcels it needed "in order to show the commitment of the D.C. government to the project." As the argument went at the time, if the District could not pull together a united front, financiers and an anchor store would be hard to come by.

That gave gastric reflux to at least some of the owners, who filed a counter suit to prevent the taking. The owners had two primary arguments: that the original PUD filed with the

Zoning Commission was filed by a group that did not include the owners - an issue that is still outstanding - and that the eminent domain proceeding was unconstitutional,

i.e., that the land was being taken for private use, not "public use" as required for eminent domain.

At this point forgive us for a brief Constitutional digression. The

5th Amendment to the Constitution reads, in part: "nor shall private property be taken for public use, without just compensation." Characteristically simple language for the foundation of U.S. law, but one that has caused recent debate. Until recently, it was obvious that sole authority for snatching land had to spring from a "public use" (building a new road or sidewalk, laying electric cables, forming a park, or even laying a railroad which served without exclusivity) - one where the government could take the land to further provision of a community service.

All that changed dramatically in 2005, when the

U.S. Supreme Court issued its decision in

Kelo, et al. v. New London, CT, et al. In the

Kelo decision, the city of New London created a development plan for a waterfront neighborhood around an upcoming

Pfizer research center. The plan was for parks, office space, retail and parking that would enhance the Pfizer site, one that was “projected to create in excess of 1,000 jobs, to increase tax and other revenues, and to revitalize an economically distressed city..." Some lifelong homeowners, however, resisted giving up their waterfront homes, so the city and a private entity called the

New London Development Corporation (NLDC), used eminent domain proceedings to oust the residents.

The Court found for the city, arguing that although much of the space would not go to "public use", the Court decided it "had long ago abandoned any literal requirement" for reading the 5th Amendment, literalism being "impractical given the diverse and always evolving needs of society." So much for the 5th Amendment. The court abandoned the "public use" requirement in favor of a "public purpose" requirement; in other words, if the local government found a generalized benefit of some sort (such as "economic development") to the community, it was free to authorize the seizure of one party's land by another party. In addition to getting value-enhancing development next door, Pfizer received corporate subsidies to encourage it to build, while the shore-front owners were soon evicted and had their homes razed.

Kelo remains the Court's official position, and the Skyland project has nearly identical circumstances. But owners here see even less public use than in

Kelo - no parks or public waterfront - distinctions that helped the court reach its decision. With the Court having lost

Justice Souter, a key liberal vote in the 5-4 opinion, another look at the same issue might find a distinction in the circumstances that warrants a different outcome. (Conservatives, more furious with Souter than ever after this decision, later proposed an eminent domain proceeding against his private New Hampshire home for the "public benefit" of turning his family home into a museum dedicated to individual liberties and the study of the Constitution. Property rights activists used the decision to launch national speaking tours).

While the ruling is a bitter pill to retailers at Skyland, the worse aspect may be the knowledge of what took place after the decision. In New London, the city removed the homeowners and bulldozed historic homes, only to have the development plan fail for lack of financing. The former neighborhood remains flattened and unused. Pfizer later announced that it will

pull out of its research center, just as its tax incentives reach their 10-year expiration.

Dana Berliner,

Attorney with the

Institute for Justice, was co-counsel on the

Kelo case. In a conversation with

DCMud, Berliner said the instance of eviction without subsequent development is a very common one. "What you are talking about here [at Skyand] is

really speculative. Its a big development in a difficult part of town...that project could easily end up destroying the jobs that already do exist at Skyland. They could spend tens of millions of dollars and end up with nothing. Now, the project actually does employ people and raise tax dollars."

Zina D. Williams, ANC Commissioner for ANC7B is more sanguine.

"We have worked carefully with the developers to ensure there will be a space for the old tenants." Will the developers have the money to proceed with construction? "Yes, they definitely do. Rappaport and the development team have been working with assisting [owners]. ANC7B and the developers have been working very hard to accomplish what's best for the project; we are confident this project will go forward, we definitely support the development team."

In the wake of Kelo, many states revised their eminent domain laws to prevent such abuse, but the District did not. Elaine Mittleman, an attorney representing several of the parties in litigation with the District and aware of the

Kelo fallout, refutes the notion that owners and tenants have been well cared for, and notes that this development is "highly speculative." Mittleman believes the developers have neither sufficient financing nor any substantial tenants, despite having previously teased the community with the promise of a

Target. Representatives at Target have repeatedly denied they have any plans to open a store there, and the Skyland website says only that "the site is being marketed to prospective tenants."

Mittlement notes a change for the worse once NCRC was abolished and negotiations shifted to District attorneys, claiming that the District has never negotiated in good faith with the current owners, some of whom have come to agreements on a buy-out, only to have the offer reneged when the District took over from NCRC. But others may have it still worse. "While the owners have a right to 'just compensation,' tenants don't have such rights and have never received an offer to be made whole...and while homeowners must be relocated, businesses have no such right, and the District has done very little to help them."

The

Mayor's office says only that "there are several outstanding legal issues associated with the project that have complicated the development process, but the District is working closely with the development team...to accelerate the pre-development work so the project moves on a parallel track with the legal process." Mittleman contends that fighting eviction during a recession has pushed several of her clients close to bankruptcy. "Some of the business that are now shuttered were operating when the this plan became known, this process has already forced some to close." Berliner supports that contention. "Many, if not most, condemned business do not reopen. They almost never get enough to start over" she said, citing the Nationals Ballpark as an example of eminent domain that cost alot more and produced less development than predicted.

Councilmember Kwame Brown, who may have the last word on the subject, told

DCMud that property owners are at fault for not listening to the community and allowing their businesses and Skyland to become blighted. Brown said neighbors want to be able to shop in their community, but have had to watch as other neighborhoods throughout the city have been redeveloped, some of which came about through eminent domain. "The community is sympathetic toward the owners, but it's hard to attract an anchor tenant when you are mired in a lawsuit...We are going to move forward and get this done. We will develop Skyland shopping center."

Washington, DC real estate development news

The best views in Montgomery County will be up for grabs when JBG begins leasing MoCo's tallest building in the coming days.

According to The JBG Companies' Marketing Manager, Julie Contos, the first of North Bethesda Market's 397 rental apartments are scheduled for delivery the Summer of 2010, but will become available for lease by "late Spring" but the group has not finalized the rates yet.

In case you haven't heard, North Bethesda Market is the mixed-use development located off Rockville Pike across from the White Flint Mall; at 24 stories a dwarf by NYC standards, but that nonetheless made its way into the (local) high-rise record books after topping off last August.

HKS Architects designed the 187-unit tower, as well as a 6-story, 210-unit apartment building and 200,000 s.f. of retail that make up the Everest of local architecture. In a discussion with DCMud, Mike Nicolaus, Managing Director of the DC office of HKS, says the project and the designers behind it are at "the front-end" of a "broader transition" taking place throughout the beltway, a shift to "higher-density, more walkable, transit-oriented communities." And in an effort to achieve what Nicolaus calls a "more urban street grid," Executive Boulevard was extended to connect with Rockville Pike.In addition to serving as home to the Food and Drug Administration's offices, two of JBG's Office Buildings at 11400 Rockville Pike and 5515 Security Lane act as partial anchors to the development. Look for an additional Whole Foods and LA Fitness anchor to open later in the Summer or early this Fall.

The best views in Montgomery County will be up for grabs when JBG begins leasing MoCo's tallest building in the coming days.

According to The JBG Companies' Marketing Manager, Julie Contos, the first of North Bethesda Market's 397 rental apartments are scheduled for delivery the Summer of 2010, but will become available for lease by "late Spring" but the group has not finalized the rates yet.

In case you haven't heard, North Bethesda Market is the mixed-use development located off Rockville Pike across from the White Flint Mall; at 24 stories a dwarf by NYC standards, but that nonetheless made its way into the (local) high-rise record books after topping off last August.

HKS Architects designed the 187-unit tower, as well as a 6-story, 210-unit apartment building and 200,000 s.f. of retail that make up the Everest of local architecture. In a discussion with DCMud, Mike Nicolaus, Managing Director of the DC office of HKS, says the project and the designers behind it are at "the front-end" of a "broader transition" taking place throughout the beltway, a shift to "higher-density, more walkable, transit-oriented communities." And in an effort to achieve what Nicolaus calls a "more urban street grid," Executive Boulevard was extended to connect with Rockville Pike.In addition to serving as home to the Food and Drug Administration's offices, two of JBG's Office Buildings at 11400 Rockville Pike and 5515 Security Lane act as partial anchors to the development. Look for an additional Whole Foods and LA Fitness anchor to open later in the Summer or early this Fall. As for the names of the additional retailers setting up shop along the Pike: Nicolaus can only tell us that JBG is "working on getting new deals in place." A spokesman from JBG was equally cryptic but promised that news on that front will be coming available "in the next couple of weeks."

As for the names of the additional retailers setting up shop along the Pike: Nicolaus can only tell us that JBG is "working on getting new deals in place." A spokesman from JBG was equally cryptic but promised that news on that front will be coming available "in the next couple of weeks."

whimsical surprises by less well-known artists like Tom Otterness whose bronze alligator crawls out of a manhole on the platform to grab a hapless sculpture or

whimsical surprises by less well-known artists like Tom Otterness whose bronze alligator crawls out of a manhole on the platform to grab a hapless sculpture or